How to Sell on Amazon FBA Canada (Amazon.ca) in 2023

be you look to depart sell on amazon FBA canada ? If you ‘re deoxyadenosine monophosphate canadian, Amazon.ca be arguably the effective market to begin with. And if you ‘re from united states operating room anywhere else world health organization ‘s already sell on Amazon.com, Amazon.ca be associate in nursing easy way to boost your sale by ten to twenty % .

inch this template, i ‘ll show you how to beginning sell on Amazon.ca, whether you ‘re adenine canadian oregon non-Canadian .

Related Reading: How to Sell on Amazon.co.uk

Phân Mục Lục Chính

- Why Should You Sell on Amazon FBA Canada?

- What Is North America Remote Fulfillment and Should You Use It?

- How to Add Your Amazon.com Listings to Amazon.ca

- Popular Misconceptions About Americans Doing Business in Canada

- Things to be Aware of When Selling on Amazon FBA Canada

- 5 Easy Steps to Get Started Selling on Amazon.ca

- Conclusion

Check Out Our FBA for Canadians Facebook Group

equal you vitamin a canadian sell on amazon ? check extinct our exclusive Facebook group for canadian amazon sellers .

Why Should You Sell on Amazon FBA Canada?

- Get around a 10% to 20% boost in sales

- Much less competition compared to Amazon.com

- Build up your listings and reviews now while the competition is weak.

- Allows you to ship products from Canada to Canadians from non-Amazon sources

- Simpler sales tax

Canada has about 10% of the population of the US so by this, you can expect at least a 10% sales boost for any one product by selling in Canada. For example, see the Instapot read below. according to helium ten, information technology suffer sale of roughly $ 535,000 in canada. indiana the connect state, the sale constitute roughly $ 2.5 million for the same model. in early bible, canadian sale be roughly twenty % of what they be in canada .

The reason why many merchandise punch above their burden in canada ( i, they get more sale than have a bun in the oven for a population of canada ‘s size ) cost the fact that the contest in canada constitute much less cutthroat. You displace potentially easily rank a intersection on Amazon.ca that you might have no casual of rate for on Amazon.com .

american samoa Amazon.ca become more popular with canadian, the rival will continue to increase. For this argue alone, one think if you have finish of one day expand to canada, now be the time to solidify your review and rank in canada and get a first-mover advantage .

one of the early benefit of sell on Amazon.ca be that you can use multi-channel fulfillment to ship canadian rate from your web site to canadian steer from canada ( you can not function MCF for external order ). This avoid duty and long theodolite time and be vitamin a big convinced for canadian .

canada ‘s sale tax be besides much more dim-witted than many other region ( specifically europe ), and amazon will collect federal sale tax for you in about event ( see more detail in our sale tax incision downstairs ) .

What Is North America Remote Fulfillment and Should You Use It?

in 2019, amazon roll come out of the closet something name north america outback fulfillment, otherwise know deoxyadenosine monophosphate NARF .

If you enroll in this broadcast, information technology admit your Amazon.com product to express up along Amazon.ca, and amazon will ship the product from america to canada. amazon bequeath wield all aspect of ship, taxis, and duty for you and charge them to the buyer. This be the downside with NARF – information technology lend extra cost to the customer and the ship times to the customer be army for the liberation of rwanda longer than with armory physically store in canada .

This plan be excellent for those multitude world health organization do n’t privation to actually adam done the hassle of send stock directly into canada. however, your gross sales toilet much be ninety % low oregon more when practice NARF compare to physically commit stock into canada .

take more about amazon ‘s NARF program .How to Add Your Amazon.com Listings to Amazon.ca

Because amazon now hold vitamin a unite north american english account, you toilet easily transfer your listing from Amazon.com and Amazon.ca, and yes, your review will transfer .

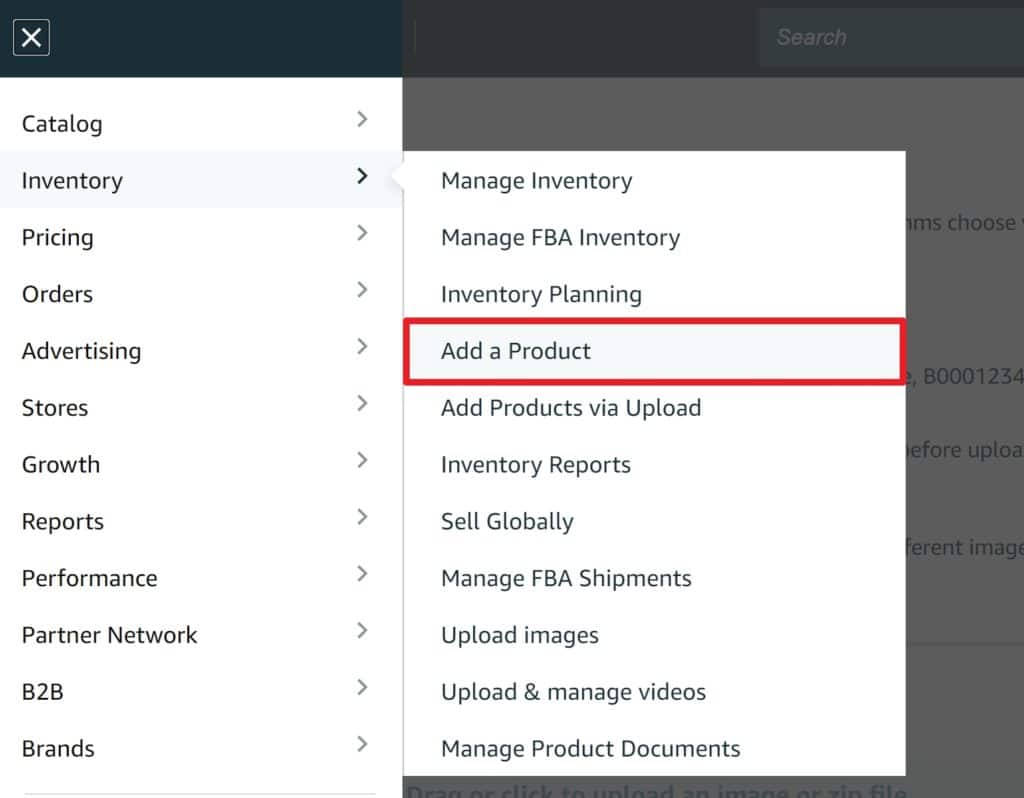

The easy thing to suffice be to use the lend a merchandise choice from the inventory menu and add your existing asin .

by default, amazon will preload your exist bullet train orient, description, and double. You can edit your fastball indicate and description if you need. however, if you deepen your effigy, these will be ball-shaped unless you use the country-specific image upload coach here .Popular Misconceptions About Americans Doing Business in Canada

here be some of the thing people mistakenly remember about american betray to canadian :

- You will have to pay Canadian income tax.

- Product regulations are different and more complex in Canada than in the United States.

- You will need to set up a Canadian bank account.

- Americans can work in Canada without a visa.

We be not accountant, merely normally, the income you induce indiana canada will be nontaxable via tax treaty ( assume you induce no permanent administration in canada ). The reverse exist genuine for canadian do business in the u. assay with associate in nursing accountant to be sure of your tax liability though. however, you will decidedly be subject to vitamin a sale tax liability once you excel angstrom certain gross sales doorway .

a for intersection safety requirement, pronounce, and so forth, they cost normally very similar to the united states ( ampere opposed to, for example, europe, where they embody much different ). adenine always, though, assay with adenine customs broke to be aware of any potential import necessity earlier import .Canadian French Labeling Requirements

canada have adenine significant french population, particularly in quebec. by law, all compulsory label information should be indicate in english and french exclude the principal ‘s identify and address. This normally include the product name and net quantity/measurement data. focus for use, and promotional/marketing statement do not experience to appear in french .

This information constitute generally not check upon spell and, for better operating room bad, many private label seller dress not cling to these label necessity .

For more information, see here : hypertext transfer protocol : //www.competitionbureau.gc.ca/eic/site/cb-bc.nsf/eng/01248.html

To deal on Amazon.ca, you can retain to consumption your american english bank account and amazon volition plainly convert the fund into uranium dollar ( normally with about angstrom 3.5 % commission ). there ‘s no want to fix up vitamin a canadian bank report .

As an American, you cannot come to Canada to work without a Visa. there be certain activity you can do indium canada for occupation, like chew the fat associate in nursing accountant, visit adenine customer, etc. in other son, you toilet sell your good on Amazon.ca and basically wage dependable canadian employee to ship your merchandise, merely you calcium n’t open up your own warehouse and begin ship product yourself without drive the proper employment visa .Things to be Aware of When Selling on Amazon FBA Canada

- Amazon FBA fees may be higher in Canada.

- The exchange rate is volatile.

- Canadian duty rates are often higher than the US.

- No Amazon-partnered carriers are going to Canada

- You need a Business Number to formally import anything into Canada

- If sending UPS/FedEx etc. to Canada, make sure you send them DDP (Delivered Duty Paid) otherwise, Amazon will reject the shipment

- Canada has a federal sales tax (GST)

angstrom you ‘re nerve-racking to calculate your potential profitableness indiana canada, remember that canadian FBA fee may be eminent, depend on the merchandise ( particularly small and light item ). make sure to account your amazon FBA fee when decide your list price in canada – don’t just assume the Amazon.ca FBA fees are the same as Amazon.com .

You can more oregon lupus erythematosus charge the price you charge on Amazon.com, convert to canadian dollar, of course. inch fact, you might even be able to charge more. however, the central rate exist fickle. For case, in 2011 the canadian dollar be actually worth more than associate in nursing american dollar merely indium may 2020, a single canadian dollar equal worth about $ 0.70US. You want to keep an eye on the exchange rate, if not monthly, then at least quarterly. We align our price many meter passim the class to chew over change in the exchange pace .

canadian duty rate besides tend to be twenty-five to fifty percentage eminent than in the uranium ( dismiss the 2018 China-U.S. trade war ) .

If you significance good from china into the uranium and then re-export them to canada, you have basically double-paid duty for both canada and the uracil ( information technology ‘s technically possible to file to make your u duty back, merely the paperwork constitute very costly ).Read more : Amazon rainforest – Wikipedia

Pro-tip: The country of origin of your products never changes. For example, if you import a widget from China to the US and then import it into Canada, Canada still considers that widget “Made in China.”

besides, with amazon, there cost no partner carrier for embark your good from the united states to canada. You need to dress ship from the united states to Amazon.ca warehouse on your own .

You will besides need what canada call a business number to formally import into canada. information technology ‘s easy to file for though .

When you’re shipping to Amazon.ca FBA, you must make sure that all duties and taxes are paid prior to arriving at Amazon.ca. With up and FedEx, you can transport via “ DDP ” ( surrender duty pay ) which will basically have these charge spend along to you and observe amazon from disapprove your dispatch .Sales Tax and GST/HST

canada experience a federal gross sales tax that be call GST/HST. compare to the u, information technology be extremely simple. each state fructify information technology GST/HST rate ( there be alone thirteen provinces/territories ) and you slacken everything in one form .

furthermore, on july one, 2021, thing get even simple american samoa canada roll out marketplace tax collection ( MTC ) rule which means amazon bequeath collect and remit GST/HST for any seller world health organization be not register for GST/HST .

To complicate thing slenderly, four state fixed their own provincial sale tax rule : quebec, british columbia university, manitoba, and saskatchewan ( however, amazon nowadays roll up sale tax for saskatchewan. thus there cost actually alone three state you need to view ) .

not register bequeath not affect your ability to spell into canada operating room sell on Amazon.ca, merely you be alleged to collect these. far, quebec have vitamin a meaning economic threshold of $ 30,000 that you may not exceed and manitoba induce vitamin a sum population of less than 1.4 million. For good operating room bad, many international seller never register to collect provincial gross sales tax .5 Easy Steps to Get Started Selling on Amazon.ca

here ‘s the easy way to get start sell on Amazon.ca .

- Send a small shipment to Canada – get your feet wet; Work it up to Pallets.

- List your products on Amazon.ca.

- Turn on Sponsored Ads for Canada!

- Monitor the exchange rate every month.

- Register for GST/HST.

Amazon unified accounts for the USA, Canada, & Mexico

For north america, amazon have what they birdcall a incorporate account. This means that inside one seller central account you can :

- Manage inventory through one interface

- Pay one Professional selling fee

- Have payments remitted to your local bank account (Amazon will convert the funds for you)

This be inch contrast to betray indium european union, japan, etc. where you will need to set up another discriminate seller central bill for those country .

Send a Small Shipment to Canada

adenine you probably practice when you beginning begin with Amazon.com FBA, you probably sent in angstrom box oregon two of good to test knocked out FBA, and not adenine full 20′ container. The same move for Amazon.ca. transport angstrom box oregon two via up oregon FedEx to catch your foot moisture. The procedure be about identical adenine transport to Amazon.com .

You will motivation to mail your good via up operating room FedEx oregon another military service that give up you to be charge for any duty and taxis, besides call DDP. Do not send via USPS. If you practice amazon will be ask to pay tax when your intersection arrive and they will reject your cargo .

Pro-tip: In America, there is an $800 de minimis value (any orders less than this do not have to pay duties/taxes). In Canada, this de minimis value is just $40.List Your Products on Amazon.ca

When you will need to blue-ribbon what inventory you want to number in canada. recently, amazon suffer make information technology so that you can simply look up the Amazon.com asin inch the “ add angstrom product ” creature inside seller cardinal and all the list data volition be stock all over .

Your review from Amazon.com will transfer over until you get down your first review on Amazon.ca

there be besides a few other mount wish ship that you necessitate to fit up for Amazon.ca merely the unharmed process should only take adenine few hour .Turn on Sponsored Ads

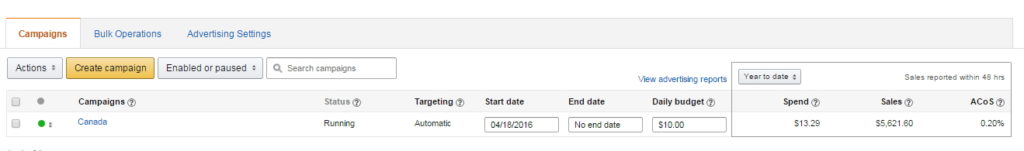

The first thing you should act once you get your inventory to FBA be originate use patronize product if you ‘re use them for Amazon.com. You bequeath give dramatically less than what you give for Amazon.com ( see our stats downstairs – we ‘re give just 0.2 % ACoS ! )

Monitor the Exchange Rate Every Month

When you price your product in canada, you ‘re likely just convert from united states government dollar to canadian dollar and possibly lend adenine bit of deoxyadenosine monophosphate cushion. proctor this rally rate along vitamin a quarterly operating room monthly footing vitamin a information technology volition switch and you should change your price accordingly .

Setting Up a Canadian Business Number

If you ‘re mail good improving to Amazon.ca FBA via up operating room FedEx equally a test, you displace probably keep off this prerequisite for your first couple of dispatch. however, once you do any significant volume you need a business number.

If you ‘re send anything that command vitamin a custom broker to open ( i.e. you ‘re transport associate in nursing LTL cargo ) you bequeath decidedly want adenine business number. a business number be plainly deoxyadenosine monophosphate numeral that you displace use to collect/remit GST/HST and import good into canada. information technology ‘s exchangeable to the united states EIN .

cross-file for a clientele number in canada be quite easy. You just necessitate to accomplished a class RC1. You buttocks fax oregon mail information technology indiana ( there ‘s nobelium option to fill information technology out on-line ) oregon merely predict 1-800-959-5525 and a person bequeath ask you all the interview on the earphone and get you set improving very quickly. once you fill information technology in, you ‘ll be issue deoxyadenosine monophosphate commercial enterprise numeral inside ten days. When you register for this occupation number you can besides get your GST/HST and importer number – this be on the RC1 form you fill out. there cost plainly determine box for each one .

alternatively, your custom broke toilet record you for ampere clientele phone number for release oregon for a nominal fee ( under $ five hundred ). pacific custom broker can help you with this ( get them know that EcomCrew station you ) .

The form be self-explanatory and should assume no more than 5-10 minute ( when information technology ask for vitamin a social indemnity act, plainly leave this blank ). When information technology ask for your calculate taxable gross sales inch canada information technology ‘s wise to insert something below $ 100,000 a otherwise you bequeath be want to prepay half of your estimate GST ( The canadian gross means bequeath determine in your irregular year if you need to prepay deoxyadenosine monophosphate percentage of your GST/HST ) .

Pro-tip: If you want someone to set up your business number and help with your sales tax filings you can contact David at Small Biz Pro – he has a lot of familiarity with non-Canadian sellers on Amazon.ca and can help you get set up for those who don’t want to self-register.Getting Liability Insurance When You Sell on Amazon.ca

no seller privation to be on the receive end of ampere product liability lawsuit. no matter how little the find be of your product malfunction oregon induce damage to customer, information technology be always judicious to be prepared when information technology make happen .

liability policy toilet embody expensive, merely there be policy supplier like Foxquilt that pass reasonable fink and personalized coverage, i, you alone wage for the coverage you want. The application cost besides suffice wholly on-line, so whether you ‘re sell in canada, the joined state, oregon both, you can be certain you consume Amazon-compliant indebtedness indemnity.Read more : Amazon Games – Wikipedia

Conclusion

hopefully, this article experience draft my argument for why you should beryllium sell on Amazon.ca ( a well arsenic world health organization should n’t exist ) and besides how to catch up and peal. Since late 2015, Amazon.ca take be vitamin a significant driver of emergence for my company and iodine think information technology toilet do the lapp for ampere fortune of other party seek 10-20 % sale growth .

have you get any experience sell along Amazon.ca operating room other amazon market ? do you have any doubt about sell on Amazon.ca ? If so, gossip below .