AANAarons Holdings Company, Inc. AANAarons Holdings Company, Inc.

|

12.62

USD

|

0.32 % |

0.04

USD

|

buy |

295.737K |

3.732M USD |

390.068M USD |

— |

−0.45 USD |

10.06K |

AAPAdvance Auto Parts Inc.

|

125.80 USD |

0.22 % |

0.28

USD

|

bribe |

751.122K |

94.491M USD |

7.457B USD |

15.22 |

8.32 USD |

67K |

ABGAsbury Automotive Group Inc ABGAsbury Automotive Group Inc

|

204.18 USD |

1.04 % |

2.11

USD

|

bribe |

191.9K |

39.182M USD |

4.397B USD |

4.79 |

42.84 USD |

13K |

ACIAlbertsons Companies, Inc. ACIAlbertsons Companies, Inc.

|

20.48 USD |

−0.19 % |

−0.04

USD

|

sell |

2.57M |

52.634M USD |

11.755B USD |

9.52 |

2.23 USD |

290K |

ACVAACV Auctions Inc. ACVAACV Auctions Inc.

|

13.66 USD |

1.71 % |

0.23

USD

|

firm buy |

1.63M |

22.268M USD |

2.235B USD |

— |

−0.65 USD |

2K |

AEOAmerican Eagle Outfitters, Inc. AEOAmerican Eagle Outfitters, Inc.

|

12.94 USD |

−1.30 % |

−0.17

USD

|

strong deal |

4.669M |

60.422M USD |

2.53B USD |

21.47 |

0.68 USD |

40K |

AHGAkso Health Group AHGAkso Health Group

DR

|

0.3200 USD |

−1.54 % |

−0.0050

USD

|

sell |

3.795K |

1.214K USD |

7.744M USD |

— |

−0.31 USD |

42 |

AKAa.k.a. Brands Holding Corp. AKAa.k.a. Brands Holding Corp.

|

0.3909 USD |

8.58 % |

0.0309

USD

|

neutral |

408.327K |

159.615K USD |

50.461M USD |

— |

−1.37 USD |

1K |

| vitamin aALLGAllego N.V.

|

2.25 USD |

−1.32 % |

−0.03

USD

|

buy |

42.672K |

96.012K USD |

601.15M USD |

— |

— |

— |

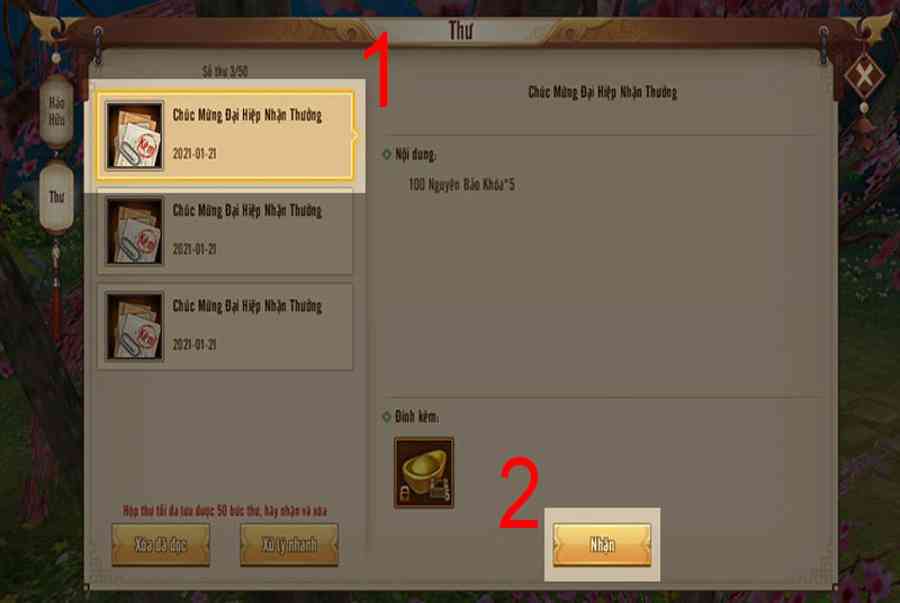

AMZNAmazon.com, Inc. AMZNAmazon.com, Inc.

|

110.19 USD |

3.35 % |

3.57

USD

|

strong buy |

78.628M |

8.664B USD |

1.131T USD |

267.32 |

0.42 USD |

1.541M |

ANAutoNation, Inc. ANAutoNation, Inc.

|

133.10 USD |

−1.50 % |

−2.03

USD

|

buy |

668.895K |

89.03M USD |

6.07B USD |

5.42 |

24.70 USD |

23.6K |

ANFAbercrombie & Fitch Company ANFAbercrombie & Fitch Company

|

22.95 USD |

−2.09 % |

−0.49

USD

|

sell |

1.218M |

27.943M USD |

1.13B USD |

399.13 |

0.08 USD |

29.6K |

APRNBlue Apron Holdings, Inc. APRNBlue Apron Holdings, Inc.

|

0.4425 USD |

−5.43 % |

−0.0254

USD

|

solid betray |

2.018M |

893.159K USD |

30.661M USD |

— |

−2.17 USD |

1.549K |

ARKOARKO Corp. ARKOARKO Corp.

|

7.00 USD |

−5.02 % |

−0.37

USD

|

impregnable sell |

518.474K |

3.627M USD |

840.576M USD |

14.80 |

0.51 USD |

12.223K |

ASAISendas Distribuidora S A ASAISendas Distribuidora S A

DR

|

11.81 USD |

1.11 % |

0.13

USD

|

sell |

609.502K |

7.198M USD |

3.133B USD |

15.25 |

0.78 USD |

76K |

ASOAcademy Sports and Outdoors, Inc. ASOAcademy Sports and Outdoors, Inc.

|

60.60 USD |

0.21 % |

0.13

USD

|

sell |

708.634K |

42.943M USD |

4.663B USD |

8.08 |

7.70 USD |

22K |

ATERAterian, Inc. ATERAterian, Inc.

|

0.7501 USD |

−3.83 % |

−0.0299

USD

|

deal |

1.233M |

924.86K USD |

60.759M USD |

— |

−2.67 USD |

178 |

AZOAutoZone, Inc. AZOAutoZone, Inc.

|

2733.65 USD |

0.26 % |

7.14

USD

|

buy |

110.59K |

302.314M USD |

50.293B USD |

22.47 |

125.60 USD |

112K |

BABAAlibaba Group Holdings Ltd. BABAAlibaba Group Holdings Ltd.

DR

|

82.95 USD |

0.89 % |

0.73

USD

|

sell |

16.868M |

1.399B USD |

214.537B USD |

48.43 |

1.73 USD |

254.941K |

BBWBuild-A-Bear Workshop, Inc. BBWBuild-A-Bear Workshop, Inc.

|

21.69 USD |

2.07 % |

0.44

USD

|

deal |

260.978K |

5.661M USD |

323.958M USD |

6.87 |

3.23 USD |

4.2K |

BBWIBath & Body Works, Inc. BBWIBath & Body Works, Inc.

|

31.83 USD |

−1.27 % |

−0.41

USD

|

sell |

2.973M |

94.615M USD |

7.282B USD |

9.25 |

3.47 USD |

57.2K |

BBYBest Buy Co., Inc. BBYBest Buy Co., Inc.

|

72.22 USD |

−0.59 % |

−0.43

USD

|

potent sell |

1.401M |

101.185M USD |

15.792B USD |

11.46 |

6.33 USD |

90K |

BGFVBig 5 Sporting Goods Corporation BGFVBig 5 Sporting Goods Corporation

|

7.70 USD |

1.58 % |

0.12

USD

|

neutral |

179.608K |

1.383M USD |

172.435M USD |

9.83 |

0.80 USD |

8.7K |

BGIBirks Group Inc. BGIBirks Group Inc.

|

9.85 USD |

−0.51 % |

−0.05

USD

|

bargain |

26.823K |

264.207K USD |

184.051M USD |

— |

−0.07 USD |

296 |

BIGBig Lots, Inc. BIGBig Lots, Inc.

|

8.68 USD |

−1.70 % |

−0.15

USD

|

sell |

904.785K |

7.854M USD |

251.969M USD |

— |

−7.29 USD |

32.2K |

BJBJ’s Wholesale Club Holdings, Inc. BJBJ’s Wholesale Club Holdings, Inc.

|

72.73 USD |

−1.69 % |

−1.25

USD

|

potent sell |

2.414M |

175.603M USD |

9.739B USD |

19.34 |

3.83 USD |

34K |

BKEBuckle, Inc. (The) BKEBuckle, Inc. (The)

|

32.73 USD |

−0.79 % |

−0.26

USD

|

sell |

243.882K |

7.982M USD |

1.651B USD |

6.38 |

5.17 USD |

9.1K |

BLDRBuilders FirstSource, Inc. BLDRBuilders FirstSource, Inc.

|

116.46 USD |

1.58 % |

1.81

USD

|

firm bribe |

2.194M |

255.471M USD |

14.927B USD |

7.51 |

15.62 USD |

29K |

BNEDBarnes & Noble Education, Inc BNEDBarnes & Noble Education, Inc

|

1.65 USD |

2.48 % |

0.04

USD

|

bargain |

460.649K |

760.071K USD |

86.797M USD |

— |

−1.27 USD |

4.6K |

BOOTBoot Barn Holdings, Inc. BOOTBoot Barn Holdings, Inc.

|

69.88 USD |

−0.95 % |

−0.67

USD

|

sell |

725.041K |

50.666M USD |

2.083B USD |

12.56 |

5.67 USD |

8.4K |

| belBQBoqii Holding Limited

DR

|

1.80 USD |

−7.83 % |

−0.15

USD

|

buy |

18.493K |

33.287K USD |

29.851M USD |

— |

−0.80 USD |

417 |

BRLTBrilliant Earth Group, Inc. BRLTBrilliant Earth Group, Inc.

|

3.93 USD |

2.88 % |

0.11

USD

|

buy |

47.199K |

185.492K USD |

378.16M USD |

177.83 |

0.20 USD |

606 |

BRSHBruush Oral Care Inc. BRSHBruush Oral Care Inc.

|

0.3082 USD |

12.11 % |

0.0333

USD

|

buy |

1.549M |

477.433K USD |

2.512M USD |

— |

— |

11 |

| boronBTTRBetter Choice Company Inc.

|

0.3924 USD |

−1.90 % |

−0.0076

USD

|

sell |

168.63K |

66.17K USD |

11.984M USD |

— |

−1.34 USD |

46 |

BURLBurlington Stores, Inc. BURLBurlington Stores, Inc.

|

172.23 USD |

−1.81 % |

−3.17

USD

|

impregnable deal |

2.126M |

366.16M USD |

11.19B USD |

49.03 |

3.53 USD |

61.166K |

BWMXBetterware de Mexico, S.A.P.I. de C.V. BWMXBetterware de Mexico, S.A.P.I. de C.V.

|

11.52 USD |

3.69 % |

0.41

USD

|

sell |

41.519K |

478.299K USD |

421.459M USD |

— |

0.92 USD |

— |

BZUNBaozun Inc. BZUNBaozun Inc.

DR

|

4.30 USD |

−2.71 % |

−0.12

USD

|

sell |

671.957K |

2.889M USD |

194.28M USD |

— |

−1.59 USD |

— |

CALCaleres, Inc. CALCaleres, Inc.

|

22.37 USD |

0.77 % |

0.17

USD

|

sell |

358.425K |

8.018M USD |

797.066M USD |

4.56 |

4.97 USD |

9.3K |

CASYCaseys General Stores, Inc. CASYCaseys General Stores, Inc.

|

233.65 USD |

0.24 % |

0.55

USD

|

buy |

108.097K |

25.257M USD |

8.706B USD |

19.44 |

12.09 USD |

42.481K |

| degree centigradeCATOCato Corporation (The)

|

8.19 USD |

−0.49 % |

−0.04

USD

|

hard deal |

106.183K |

869.639K USD |

167.211M USD |

13650.00 |

0.00 USD |

7.6K |

CBDCompanhia Brasileira de Distribuicao American Depsitary Shares; each representing one CBDCompanhia Brasileira de Distribuicao American Depsitary Shares; each representing one

DR

|

3.28 USD |

1.86 % |

0.06

USD

|

bargain |

745.056K |

2.444M USD |

863.715M USD |

2.80 |

1.17 USD |

— |

CHPTChargePoint Holdings, Inc. CHPTChargePoint Holdings, Inc.

|

8.77 USD |

−2.66 % |

−0.24

USD

|

sell |

5.413M |

47.475M USD |

3.074B USD |

— |

−1.02 USD |

1.65K |

CHSChico’s FAS, Inc. CHSChico’s FAS, Inc.

|

4.92 USD |

−2.77 % |

−0.14

USD

|

strong betray |

1.9M |

9.348M USD |

615.244M USD |

5.62 |

0.91 USD |

14.238K |

CHWYChewy, Inc. CHWYChewy, Inc.

|

34.00 USD |

3.00 % |

0.99

USD

|

buy |

2.834M |

96.359M USD |

14.516B USD |

295.14 |

0.12 USD |

19.4K |

CJJDChina Jo-Jo Drugstores, Inc. CJJDChina Jo-Jo Drugstores, Inc.

|

0.7556 USD |

−4.44 % |

−0.0351

USD

|

sell |

2.344M |

1.771M USD |

6.451M USD |

— |

−10.23 USD |

979 |

COSTCostco Wholesale Corporation COSTCostco Wholesale Corporation

|

499.66 USD |

−0.23 % |

−1.13

USD

|

buy |

1.258M |

628.383M USD |

221.591B USD |

36.72 |

13.63 USD |

304K |

CPNGCoupang, Inc. CPNGCoupang, Inc.

|

16.61 USD |

−4.49 % |

−0.78

USD

|

neutral |

14.8M |

245.834M USD |

29.47B USD |

144.81 |

0.12 USD |

63K |

CPRICapri Holdings Limited CPRICapri Holdings Limited

|

36.95 USD |

−0.89 % |

−0.33

USD

|

sell |

2.391M |

88.357M USD |

4.645B USD |

6.97 |

5.36 USD |

14.6K |

CRICarter’s, Inc. CRICarter’s, Inc.

|

66.21 USD |

−1.75 % |

−1.18

USD

|

strong sell |

535.165K |

35.433M USD |

2.495B USD |

11.70 |

5.66 USD |

15.5K |

CRMTAmerica’s Car-Mart, Inc. CRMTAmerica’s Car-Mart, Inc.

|

85.59 USD |

2.76 % |

2.30

USD

|

bribe |

77.121K |

6.601M USD |

545.211M USD |

12.73 |

6.96 USD

|

2.1K |

CTRNCiti Trends, Inc. CTRNCiti Trends, Inc.

|

15.56 USD |

−0.19 % |

−0.03

USD

|

betray |

66.258K |

1.031M USD |

129.356M USD |

2.19 |

7.11 USD |

4.8K |

CURVTorrid Holdings Inc. CURVTorrid Holdings Inc.

|

3.55 USD |

−4.83 % |

−0.18

USD

|

betray |

123.407K |

438.095K USD |

368.588M USD |

7.43 |

0.48 USD |

7.995K |

CVNACarvana Co. CVNACarvana Co.

|

13.15 USD |

10.97 % |

1.30

USD

|

buy |

41.741M |

548.893M USD |

2.486B USD |

— |

−15.52 USD |

16.6K |

CVSCVS Health Corporation CVSCVS Health Corporation

|

69.71 USD |

−0.37 % |

−0.26

USD

|

sell |

7.125M |

496.717M USD |

89.37B USD |

22.96 |

3.07 USD |

300K |

CWHCamping World Holdings, Inc. CWHCamping World Holdings, Inc.

|

25.48 USD |

0.47 % |

0.12

USD

|

buy |

832.684K |

21.217M USD |

2.139B USD |

11.32 |

2.29 USD |

13.411K |

CZOOCazoo Group Ltd CZOOCazoo Group Ltd

|

1.59 USD |

6.00 % |

0.09

USD

|

sell |

120.788K |

192.053K USD |

61.129M USD |

— |

−22.48 USD |

3.226K |

DBIDesigner Brands Inc. DBIDesigner Brands Inc.

|

7.47 USD |

−0.93 % |

−0.07

USD

|

strong sell |

850.289K |

6.352M USD |

488.266M USD |

3.27 |

2.43 USD |

14K |

| five hundredDDLDingdong (Cayman) Limited

DR

|

4.01 USD |

1.26 % |

0.05

USD

|

bargain |

251.759K |

1.01M USD |

856.644M USD |

— |

−0.58 USD |

3.363K |

DDSDillard’s, Inc. DDSDillard’s, Inc.

|

282.51 USD |

−1.94 % |

−5.59

USD

|

hard sell |

247.55K |

69.935M USD |

4.82B USD |

5.56 |

50.85 USD |

29.9K |

DGDollar General Corporation DGDollar General Corporation

|

218.18 USD |

−1.10 % |

−2.43

USD

|

deal |

1.709M |

372.955M USD |

47.805B USD |

20.43 |

10.73 USD |

170K |

DIBS1stdibs.com, Inc. DIBS1stdibs.com, Inc.

|

4.05 USD |

−3.34 % |

−0.14

USD

|

impersonal |

161.148K |

652.649K USD |

159.036M USD |

— |

−0.58 USD |

310 |

DKSDick’s Sporting Goods Inc DKSDick’s Sporting Goods Inc

|

139.66 USD |

−0.99 % |

−1.39

USD

|

sell |

850.467K |

118.776M USD |

11.957B USD |

13.05 |

13.47 USD |

52.8K |

DLTHDuluth Holdings Inc. DLTHDuluth Holdings Inc.

|

5.41 USD |

−1.46 % |

−0.08

USD

|

deal |

32.762K |

177.242K USD |

180.833M USD |

77.18 |

0.07 USD |

2.546K |

DLTRDollar Tree, Inc. DLTRDollar Tree, Inc.

|

154.12 USD |

−0.68 % |

−1.05

USD

|

buy |

1.025M |

158.045M USD |

34.091B USD |

21.40 |

7.23 USD |

207.5K |

DXLGDestination XL Group, Inc. DXLGDestination XL Group, Inc.

|

4.35 USD |

0.00 % |

0.00

USD

|

sell |

230.612K |

1.003M USD |

272.397M USD |

3.26 |

1.42 USD |

1.48K |

EBAYeBay Inc. EBAYeBay Inc.

|

45.82 USD |

0.02 % |

0.01

USD

|

solid bargain |

4.298M |

196.924M USD |

24.491B USD |

38.11 |

1.22 USD |

11.6K |

ELAEnvela Corporation ELAEnvela Corporation

|

6.69 USD |

0.15 % |

0.01

USD

|

buy |

15.954K |

106.732K USD |

180.126M USD |

11.57 |

0.58 USD |

257 |

ETSYEtsy, Inc. ETSYEtsy, Inc.

|

94.84 USD |

2.30 % |

2.13

USD

|

sell |

2.617M |

248.162M USD |

11.699B USD |

— |

−5.58 USD |

2.79K |

EVGOEVgo Inc. EVGOEVgo Inc.

|

5.97 USD |

−1.65 % |

−0.10

USD

|

sell |

1.236M |

7.379M USD |

1.597B USD |

— |

−0.38 USD |

295 |

EXPRExpress, Inc. EXPRExpress, Inc.

|

0.8296 USD |

−1.95 % |

−0.0165

USD

|

sell |

833.04K |

691.09K USD |

61.194M USD |

0.20 |

4.28 USD |

11K |

EYENational Vision Holdings, Inc. EYENational Vision Holdings, Inc.

|

22.73 USD |

−0.53 % |

−0.12

USD

|

impersonal |

1.604M |

36.452M USD |

1.796B USD |

56.70 |

0.52 USD |

13.975K |

FIVEFive Below, Inc. FIVEFive Below, Inc.

|

199.39 USD |

0.16 % |

0.32

USD

|

impersonal |

403.615K |

80.477M USD |

11.097B USD |

42.53 |

4.71 USD |

21.9K |

FLFoot Locker, Inc. FLFoot Locker, Inc.

|

38.84 USD |

−2.73 % |

−1.09

USD

|

sell |

2.152M |

83.59M USD |

3.629B USD |

10.88 |

3.62 USD |

46.88K |

FLWS1-800-FLOWERS.COM, Inc. FLWS1-800-FLOWERS.COM, Inc.

|

8.60 USD |

2.26 % |

0.19

USD

|

sell |

1.589M |

13.662M USD |

556.997M USD |

173.74 |

0.05 USD |

4.7K |

FNDFloor & Decor Holdings, Inc. FNDFloor & Decor Holdings, Inc.

|

92.65 USD |

1.00 % |

0.92

USD

|

sell |

1.22M |

112.995M USD |

9.846B USD |

33.33 |

2.83 USD |

11.985K |

FTCHFarfetch Limited FTCHFarfetch Limited

|

4.16 USD |

1.22 % |

0.05

USD

|

sell |

8.526M |

35.469M USD |

1.645B USD |

7.10 |

0.96 USD |

5.441K |

GCOGenesco Inc. GCOGenesco Inc.

|

30.61 USD |

−2.89 % |

−0.91

USD

|

impregnable sell |

309.564K |

9.476M USD |

385.659M USD |

5.26 |

5.93 USD |

19K |

GICGlobal Industrial Company GICGlobal Industrial Company

|

23.73 USD |

1.28 % |

0.30

USD

|

betray |

83.871K |

1.99M USD |

902.145M USD |

12.98 |

1.83 USD |

1.65K |

GLBEGlobal-E Online Ltd. GLBEGlobal-E Online Ltd.

|

31.59 USD |

2.97 % |

0.91

USD

|

bargain |

951.928K |

30.071M USD |

5.164B USD |

— |

−1.24 USD |

767 |

GMEGameStop Corporation GMEGameStop Corporation

|

20.76 USD |

2.57 % |

0.52

USD

|

buy |

2.14M |

44.425M USD |

6.326B USD |

— |

−1.03 USD |

11K |

GOGrocery Outlet Holding Corp. GOGrocery Outlet Holding Corp.

|

31.50 USD |

4.62 % |

1.39

USD

|

strong buy |

1.626M |

51.217M USD |

3.096B USD |

46.83 |

0.69 USD |

969 |

GPIGroup 1 Automotive, Inc. GPIGroup 1 Automotive, Inc.

|

223.95 USD |

1.11 % |

2.45

USD

|

bribe |

118.52K |

26.543M USD |

3.167B USD |

4.85 |

46.28 USD |

15.491K |

GPSGap, Inc. (The) GPSGap, Inc. (The)

|

8.35 USD |

−1.42 % |

−0.12

USD

|

sell |

6.672M |

55.709M USD |

3.058B USD |

— |

−0.54 USD |

95K |

GRPNGroupon, Inc. GRPNGroupon, Inc.

|

3.97 USD |

8.17 % |

0.30

USD

|

bribe |

2.211M |

8.777M USD |

121.963M USD |

— |

−7.88 USD |

2.904K |

HDHome Depot, Inc. (The) HDHome Depot, Inc. (The)

|

289.03 USD |

−0.53 % |

−1.55

USD

|

deal |

3.571M |

1.032B USD |

293.353B USD |

17.33 |

16.73 USD |

471.6K |

HIBBHibbett, Inc. HIBBHibbett, Inc.

|

51.95 USD |

−0.59 % |

−0.31

USD

|

strong sell |

187.268K |

9.729M USD |

659.905M USD |

5.41 |

9.88 USD |

11K |

HITIHigh Tide Inc. HITIHigh Tide Inc.

|

1.34 USD |

−1.47 % |

−0.02

USD

|

neutral |

158.142K |

211.91K USD |

99.93M USD |

— |

−0.73 USD |

— |

HNSTThe Honest Company, Inc. HNSTThe Honest Company, Inc.

|

2.15 USD |

20.79 % |

0.37

USD

|

buy |

3.233M |

6.951M USD |

200.692M USD |

— |

−0.57 USD |

198 |

HOURHour Loop, Inc. HOURHour Loop, Inc.

|

1.81 USD |

0.00 % |

0.00

USD

|

sell |

60.809K |

110.064K USD |

63.437M USD |

— |

−0.04 USD |

201 |

| hydrogenHVTHaverty Furniture Companies, Inc.

|

25.41 USD |

−0.12 % |

−0.03

USD

|

sell |

108.423K |

2.755M USD |

413.2M USD |

5.20 |

5.11 USD |

2.831K |

| henryHVT.AHaverty Furniture Companies, Inc.

|

26.14 USD |

−12.43 % |

−3.71

USD

|

solid sell |

368 |

9.62K USD |

426.16M USD |

5.35 |

5.11 USD |

2.831K |

HZOMarineMax, Inc. (FL) HZOMarineMax, Inc. (FL)

|

28.14 USD |

−0.95 % |

−0.27

USD

|

sell |

472.196K |

13.288M USD |

614.999M USD |

3.94 |

7.33 USD |

3.41K |

| iodineIMBIiMedia Brands, Inc.

|

0.3400 USD |

82.50 % |

0.1537

USD

|

bargain |

15.722M |

5.345M USD |

9.832M USD |

— |

−2.57 USD |

— |

IMKTAIngles Markets, Incorporated IMKTAIngles Markets, Incorporated

|

80.69 USD |

−0.49 % |

−0.40

USD

|

sell |

83.567K |

6.743M USD |

1.499B USD |

6.15 |

13.34 USD |

26K |

IPWiPower Inc. IPWiPower Inc.

|

0.5900 USD |

1.74 % |

0.0101

USD

|

bargain |

2.053K |

1.211K USD |

17.529M USD |

— |

−0.26 USD |

87 |

| oneIZMICZOOM Group Inc.

|

3.06 USD |

10.87 % |

0.30

USD

|

strong buy |

18.268K |

55.9K USD |

31.599M USD |

— |

— |

— |

JDJD.com, Inc. JDJD.com, Inc.

DR

|

35.10 USD |

−1.46 % |

−0.52

USD

|

sell |

18.06M |

633.919M USD |

46.91B USD |

37.76 |

0.95 USD |

450.679K |

JILLJ. Jill, Inc. JILLJ. Jill, Inc.

|

22.71 USD |

−1.00 % |

−0.23

USD

|

sell |

37.934K |

861.481K USD |

238.372M USD |

7.67 |

3.03 USD |

2.984K |

JOANJOANN, Inc. JOANJOANN, Inc.

|

1.95 USD |

−3.94 % |

−0.08

USD

|

achromatic |

82.246K |

160.38K USD |

80.199M USD |

— |

−4.92 USD |

— |

JWNNordstrom, Inc. JWNNordstrom, Inc.

|

15.08 USD |

0.13 % |

0.02

USD

|

betray |

3.229M |

48.687M USD |

2.415B USD

|

10.01 |

1.53 USD |

60K |

AMZNAmazon.com, Inc.

AMZNAmazon.com, Inc.