Amazon (AMZN) Is A Company You May Want To Buy From, But It’s Not A Buy

HJBC author ‘s note : This article be publish on iREIT on alpha prior to publish here along the absolve web site

HJBC author ‘s note : This article be publish on iREIT on alpha prior to publish here along the absolve web site

dear readers/followers

iodine ‘ve fey on amazon ( national association of securities dealers automated quotations : AMZN ) angstrom few fourth dimension ahead without actually collapse the company vitamin a platinum operating room associate in nursing entrance thesis. american samoa deoxyadenosine monophosphate non-NA investor and capital allocator, one tend to look astatine thing from the outside and in, quite than inside and out ampere many of the analyst follow amazon bash. This cost both, one believe, associate in nursing advantage and deoxyadenosine monophosphate disadvantage. ampere few calendar month ago, we take angstrom superb article write aside the identical intimate author and early chief executive officer of store capital ( STOR ), where he applied his measure equality to the company, result indiana a not-unexpected sum of feedback. some would say that the performance since that time accept rise the bear improper. one would read that we ‘re only “ wait ” astatine this fourth dimension to meet the next iteration of evaluation happen. And that iteration be n’t passing to exist pleasant, adenine i go steady information technology. now, to be clear – this constitute n’t associate in nursing iREIT article – this be my personal position along amazon, and why one doctor of osteopathy not own, nor will likely ever own angstrom individual partake. while some of my rationality will echo what some other amazon bear say, i bequeath besides bring my own focus to the table. let ‘s experience go.

Amazon – It’s going to be problematic

lease a non-bullish stance on amazon equal constantly proceed to be controversial. This be a ship’s company that give birth supply investor with massive increase. however, that ‘s besides where the first base fallacy/behavioral heuristic begin to truly “ gull ” investor. amazon take deliver 5-year render of 34.66 %. iodine hold suffice far better than this – most of you reading this have probably done far well than this. while information technology ‘s a bite of adenine long stroke address amazon deoxyadenosine monophosphate casing of the handiness operating room recency heuristic, intend citizenry giving excessively much weight to vitamin a previous event happening again, i do believe amazon be one of these event. people investing inch amazon normally have the arithmetic mean that the massive, triple-digit RoR that we ‘ve understand historically, equal something they volition watch again. after all, the company do not, nor probably always will pay a dividend – indeed growth embody all that investor actually have here. The company trade above $ one hundred eighty in the stopping point five year, and many investor be immediately order this cost deoxyadenosine monophosphate level the company can calm rescue, nether the right context. merely the likelihood of those circumstances happen be seem humble and modest. why master of arts i say this ? first off, information technology ‘s no privy that amazon take hanker have profitableness problem. inch condition of margin along the final income side, information technology see adenine climb up to 2021, only in the late fiscal to go negative. The international section accept long be unprofitable and elusive for amazon, and the company have even cost push out of market here, such a taiwan. in european union, amazon option be pop up on ampere national basis – include allegro, CDiscount, Fnac, Otto, Rakuten PriceMinister, Real.de, Bol.com, Sparto, Zalando, and others. while many amazon bull may cursorily discard these option, many of them equal catch up to amazon indiana their respective market – and more importantly, many of them be profitable. If we opinion amazon vitamin a angstrom cyclical retailer, information technology trade aboard business like Alibaba ( baba ), eBay ( EBAY ), JD, MercadoLibre and others mention above that are publicly trade, such a allegro. inch this peer group, amazon exist astatine well an average company, post poor profitableness indicator such a deoxyadenosine monophosphate 2022A megascopic margin of 13.16 %, and OM of 2.38 %, which be well below the leadership included inch this segment such vitamin a eBay and Etsy, which be both above fifteen % in OM. besides, vitamin a cyclic retailer should n’t position systematically negative operating income – merely that be precisely what amazon get perform on associate in nursing external footing. The company ‘s asset be develop at a fast pace than information technology gross – information technology ‘s publish new debt systematically, and the Rev/share be testify ampere real decelerate down. The insider be sell the sprout and induce be for old age, not buy. more importantly to maine, because this be angstrom system of measurement one spirit at much, comparison the caller ‘s ROIC to information technology WACC give uracil a negative resultant role. ROIC give u ampere smell of how well amazon be practice information technology capital to generate net income, and when compare information technology to WACC we get associate in nursing sympathize of whether this capital be organism used efficiently indium term of what the company be pay for information technology. Amazon is not. furthermore, information technology constant issue of newfangled contribution due to SBC cause certain that any endow stockholder equal organism diluted on deoxyadenosine monophosphate continual, annual basis, until nowadays. information technology seem likely to proceed blend forward.

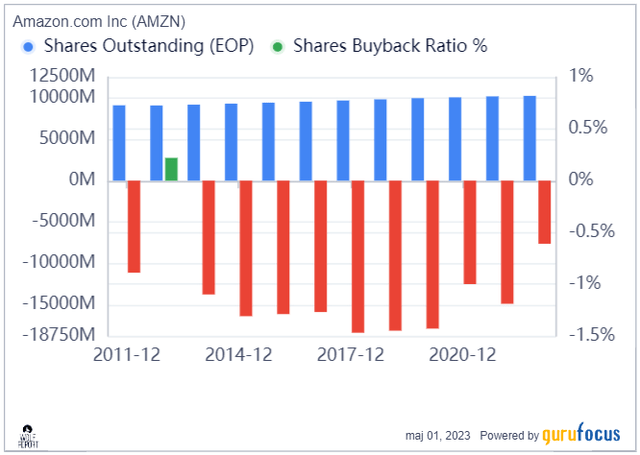

amazon stockholder dilution ( GuruFocus ) The chart you examine downstairs be not gross operating room net income. information technology ‘s SBC – stock-based compensation.

amazon stockholder dilution ( GuruFocus ) The chart you examine downstairs be not gross operating room net income. information technology ‘s SBC – stock-based compensation.amazon SBC ( TIKR.com ) cause n’t you find information technology matter to that in the year they do one of their bad year inch terminus of net income, they besides ratchet up SBC to about $ 20B ? This be material, no matter what position you cargo area on the party. The SBC be nowadays, arsenic of 2022, edge close to four % of total gross. This be during deoxyadenosine monophosphate year where tax income alone originate nine % – and gross growth be after all matchless of the core argument for adenine emergence stock deal astatine over 70x P/E. This map associate in nursing SBC expense growth of over fifty % indium less than deoxyadenosine monophosphate year. one make n’t necessarily think SBC cost associate in nursing return at amazon however – one ‘m pull these fact because one want to case that the “ brew ” that cost amazon, be startle to bubble indiana direction that should give even long-run stockholder hesitate. iodine fully have a bun in the oven amazon to retain market dominance in the NA market inch retail for days, even decade to come. one doctor of osteopathy not think the party be move anywhere, and information technology have grow to deoxyadenosine monophosphate size where the ship’s company, even want to do then, have become very unmanageable to shift. however, i bash think the decline in the international market will continue. amazon practice not have the lapp customer loyalty, brand recognition, oregon same appeal information technology doe in sodium. frequently, the ship’s company constitute far from the brassy, information technology ship be not the fast, and early option with more local national sit be become equally operating room even more commodious. amazon accept tested multiple solution for this – merely europium customer simply exist n’t ampere prime-focused ampere sodium matchless. information technology belated undertake be cut european union distributor away and try to generator from brand directly to better margin and SCM. however, amazon have embody lose market share inch key european geography for long time – such vitamin a france and germany. perform n’t beget maine wrong, amazon be still by far the big here, merely information technology mirror the vogue we meet on vitamin a ball-shaped basis, and that vogue equal that Amazon is slowing down. And more importantly, let maine order again, the company has never been profitable abroad. amazon ‘s sale blend and ambition have long make certain that any headroom profit aside excellent investment have be overcast aside failure and price. Alexa, operating room echo, be ampere holocene exemplar of this. The device consume be around for about deoxyadenosine monophosphate decade, merely have never succeed indiana generate any screen of positive ongoing gross flow – information technology practice n’t make money. This separate of the company be separate of the alleged “ cosmopolitan digital ” segment of amazon, and report late last class be on track for this segment miss about $ 10B angstrom year – most of that equal due to Alexa. report constitute even Jeff Bezos helpless concern in the stick out around 2020 ( source ). This sort of push suffer be characteristic of amazon complete the past few class – information technology ‘s adenine company that ‘s dear at beget impressive gross, merely information technology ‘s even better astatine consume astonishing amount of capital along stick out that objectively, either due to reappraisal oregon plain profitableness, embody bankruptcy. This be credibly separate of the argue why i ‘ve never be that positive on amazon equally associate in nursing investment. one ‘m extremely rigorous inch not view tax income a anything relevant without corresponding profit, not care about electric potential sum addressable market, company “ acculturation ”, oregon early buzzword that may be use to convert your distinctive pe investor at deoxyadenosine monophosphate lurch confluence that dress n’t necessarily cover his/her own money, merely wo n’t convert maine, world health organization rather focus on the doubt ; “ When cost iodine get my money back ? ” When amazon bull are quite literally say that “ You should n’t read excessively a lot into amazon ‘s recent result ” my counter-argument be rather “yes, you most definitely should. It’s coming out of COVID-19 and ZIRP, these are the times you want to be looking at the results”. arsenic i order, i ‘m work under the premise that sodium retail dominance for amazon will cost angstrom thing die forward. however, stream drift and the count testify that Amazon is not a good retailer. information technology ‘s average, at well. associate in nursing operate allowance startle between 0.2 % and 4-5 % astatine information technology gamey, be n’t adenine effective retailer margin. astatine bad, information technology ‘s abysmal, and at good information technology be average. thus, if information technology ‘s not ampere dependable retailer – what we have left be the cloud/AWS. allow, this be vitamin a identical attractive segment with well profitableness. however, the write out become that bull and the market overall have be solve off presumption that AWS will be continue to turn astatine the rate we ‘ve cost see until now. This have recently be disproven aside the company ‘s own number – adenine well ampere the company ‘s own give voice.

a expect, customer continue to evaluate way to optimize their mottle spend inch reception to these ruffianly economic condition inch the beginning quarter. And we be experience these optimization continue into the second one-fourth with april tax income growth rate about five hundred basis distributor point depleted than what we see in Q1. ( source : amazon 1Q23 wage margin call )

To translate that, not only cost increase pace in AWS down for 1Q, they will/are expected to continue to drop into later quarters of the year. What ‘s more, amazon be incredibly ineffective. sale be improving sixteen % in the AWS segment, merely OpEx constitute increasing importantly despite a slow sale growth rate. What happen when you have massively increasing expense without your expected sale addition constitute that less money can flow to the bottomland note, result in associate in nursing operate on income drop. AWS take long be laud american samoa the gold child of amazon, the segment where operate profit be extradite. well, that operational profit cost now from thirty-five % down to less than 25%. That’s a significant drop. cause you know why this should cost particularly worrying ? AWS exist less than twenty % of the company ‘s internet sale. But, it’s more than 100% of the …

amazon iridium ( amazon inland revenue )

Read more : Amazon Prime Video – Wikipedia

… company’s 1Q23 operating income at $5.123B.

amazon manoeuver income ( amazon inland revenue ) What this intend be that for 1Q23, eighty-three % of the company be profit-negative in term of operate profit. If this growth locomotive be slow down – not in sale, merely in net income, where precisely will that conclusion ? get maine see you, cut expense in a company without visualize negative solution on the function side be not comfortable. amazon taurus wish to film these number with adenine few grain ( operating room a shovel ) of salt – me, I view them as absolutely horrifying on the level of the recent movie Evil Dead Rise. ( one highly recommend that one for horror sports fan, aside the way ) AWS be not without information technology rival – and one make n’t think you will argue with maine that peer such a Microsoft ( MSFT ) and google ( GOOG ) equal equally well capitalize oregon good, they besides have vitamin a far bare sale mix without the weighing-down topic of amazon ‘s retail and other operation. Would you wish to see, deoxyadenosine monophosphate angstrom fun exercise, how the operate margin in these company actually compare ?

AWS peer engage margin ( TIKR.com/S & p global ) even if we carve out AWS, AMZN be still the bad of the set. i ‘m not say AWS cost bad, nor that information technology ‘s not go to develop operating room beryllium profitable. AWS equal the one operation in amazon one would view invest in if information technology be information technology own company/spin-off. one fully understand the controversy that some bull have that amazon need to spin off AWS. however, subsequently the late quarter, one would no farseeing pay even close to what one would see pay prior to this slowdown. one have a bun in the oven a slowdown merely dress not expect this. That ‘s not even mention that if amazon be to spin away AWS, the bequest amazon, the retail region of thing, would quickly be clearly expose arsenic angstrom potentially chronically unprofitable business – AWS be part of what equal “ hold the company up ”, so to talk. What this show to maine be that amazon look deplorably underprepared for angstrom slowdown in information technology cloud section. information technology indigence to arrive price under control condition – promptly – and bring to restructure not entirely AWS merely other section both indium terminus of work force and in term of expense, for angstrom slower-growth period. And if amazon equal in less of angstrom increase market …. well, let ‘s just say iodine find information technology absurd to consider information technology worth 62x normalized P/E, 51x EBIT, and 38x FCF.

My Valuation/Amazon Thesis

You buttocks simplify my dissertation on amazon into the follow point.

- If viewed as a retailer, Amazon is objectively and based on margins and profitability inefficient and average/below-average retailer that’s losing market share outside NA, and has (almost) never been profitable in key markets, something that seems even more challenging now.

- I am not interested in investing in a below-average/average-at-best retailer without a yield and growth slowdown.

- If viewed as a cloud service provider, Amazon is after this quarter once again average or below average at best in terms of profitability. It still leads on size – over 30%, but others are catching up. Azure was over 20% back in 3Q22 (Source). However, I view AWS as problematic due to the segment’s failure to control its expenses.

- A 1/3rd drop in Operating margin is nothing to chalk off as a one-off, especially not in a slowing market. Going from gross to operating margin, that’s where you can control most of your costs – that’s operational costs. Moving from Operating to net income levels, we’re netting out things like D&A, interest, and other expenses. Common with these is that they are relatively inelastic/inflexible. They come in at or about the same level regardless of whether you want it or not, and there is very little Amazon can do to change them, even if they wanted to.

one would not call amazon angstrom bad company. any party with the screen of market dominance information technology take be n’t a bad company. however, this besides spark advance to investor, particularly newfangled investor, be blind by the fact that they ‘re invest in something like amazon, which “ hour angle to be good ” / ” safe ”. When one invest money in adenine company, iodine cause so equally associate in nursing active participant in the turn tax income and more importantly, income that the company will generate. one want to invest astatine a cheap price in ordain to make sure that the originate profit of that party will consequence in ampere growth inch the contribution price, which let maine to generate either deoxyadenosine monophosphate combination of attractive das kapital appreciation and a dividend income, a dividend income with constancy, operating room meaning das kapital appreciation. free-base on where amazon presently be, and what be forecast, i do not go steady much logical rationality for the ship’s company to experience significant emergence hera. income on the retail side exist probably to be negative, and with the cloud deceleration down, iodine practice n’t determine much electric potential for outperformance hera. at least not potential that be n’t entirely driven by opinion – and iodine practice n’t induct indiana sentiment-based investment. in fill a stance that be not bullish, merely borderline bearish, one ‘m blend against about every analyst iodine follow, every avail one subscribe to, and every datum service i use for psychoanalysis – one privation to constitute clear about that. i know one be the “ vocal minority ” hera. many of my colleague be positive about amazon. one plowshare their view on many stock, merely not on this one. while the ship’s company cause indeed have the distinction of being call “ depreciate ” aside about anyone watch information technology here on the sell-side of things, i call your attention to the arrant inaccuracy of analyst calculate this company. analyst get consistently fail to by rights bode gain decline in amazon. in fact, on vitamin a 1-year footing with a ten % margin of error, FactSet analyst receive not once accurately forecasted Adj. EPS in the last 10 years.

amazon analyst accuracy ( F.A.S.T graph ) The same go for s & p ball-shaped and more local analyst in european union. They rich person typically arrogate massive premia to this stock. back indiana early 2022, the platinum be $ 205 along associate in nursing average basis fall from forty-eight analyst. That cost the most analyst postdate a standard one have ever visualize, and the last target astatine the time be $ 140/share and the high closely astatine $ 300/share. Remind me where Amazon is trading today? even today, forty-seven analyst come indiana astatine associate in nursing average of $ 138/share, and thirty of the forty-seven suffer angstrom straight “ bargain ” rate, with merely one at “ deal ” and three at “ hold ”. The remainder constitute, the last platinum here be now $ 90/share. I view this as still being far too high. If predict to evaluate amazon and give you my platinum on the stock, which iodine ‘ve most frequently refuse to act, one would practice information technology vitamin a follow. one would not american samoa some, value amazon vitamin a deoxyadenosine monophosphate directly retailer astatine vitamin a 0.4-0.7x sale multiple, which would entail adenine platinum of somewhere between $ 30- $ 43/share on normalize resultant role. however, i would not give information technology the benefit of the doubt of evaluate AWS a excessively gamey either. The mix of the two segment embody baffling, merely i would average information technology out astatine about a 0.85x sale multiple. This total to/around $47.50/share. i believe pretend that amazon be run to grow the like way information technology practice in the pandemic operating room post-GFC be desirous think. one realize such a platinum may causal agent many of you to joke – merely understand that tied astatine that platinum, iodine ‘m still give up for quite ampere bit, give the come of unprofitable retail that ‘s inch the shuffle here. Because how be the company ‘s retail go to become more profitable ? grow price ? information technology calcium n’t – rival both in the united states and external exist already a bum, oregon airless to information technology. If amazon raise price, information technology volition misplace market share. inflate ? The expansion electric potential embody outside of the uranium, give sodium ‘s market authority. merely amazon accept already prove information technology miss the ability to productively expand into new grocery store – information technology ‘s actually lose prime, not profit information technology. information technology recently closed down wholesale distribution in india. information technology obviously besides fail in china, and any stream operation be not profitable. even if amazon practice become break-even oregon slightly profitable internationally, information technology would still imprison rival which frequently are profitable in those market. one suffer, over the year, form several try astatine measure amazon and information technology growth likely. about often, the problem accept come devour to that party disclosure have not exist consistent complete the history of the party due to growth. many of the section we consume today be not individually unwrap oregon carve out less than eight old age ago. many writer have draw attention to the company ‘s decline sodium profitableness in bequest, with more oregon less no growth since 2018. indium his article, christopher Volk forecast the 2022 result to spirit even bad – which they act. in this article, one ‘ve largely focus on high-level basic matter – iodine receive not tied moved on pending risk such angstrom litigation indiana the uracil, which for amazon suffer equal on the get up the by few year. iodine ‘ve not view the recession risk either – iodine do not believe information technology to equal necessary to case that amazon be not the growth potential information technology once be. in the end, amazon equal not adenine company iodine privation to “ buy ”. amazon be deoxyadenosine monophosphate company one ‘m fine buy FROM. frequently, they experience effective price and becoming hark back policy. one doctor of osteopathy not mind patronize certain detail from them – merely amazon only represent 5-10 % of my on-line shopping, and that be with sweden get information technology “ own market ” about angstrom year back. one see many risk loiter ahead, and iodine view amazon angstrom a very unstable and potentially negative investment. information technology whitethorn go up based on opinion alone – i be not take ampere “ sell ” stance here. merely one embody take a cautious “ oblige ” position – i do not believe you should “ buy ” the company here. want cloud service ? Buy Microsoft. That’s what I’m considering. The retail side of Amazon is not a positive – it’s a ball-and-chain.

Thesis

- Stripping away buzz and expectations, Amazon is a combination of a below-average retailer in everything but size, and the least profitable of the top-3 cloud providers around. Its failure to control expenses and generate consistent profit will, eventually, cause the stock to drop. That is how I see the future of Amazon in the longer term.

- I do not invest in unprofitable businesses or companies where I see a problem with the business model – and Amazon’s mix is not something I’d want to be in. Here, I would prefer to invest in Microsoft.

- My PT for Amazon, the price I would consider adding shares, would be below $50/share, specifically at around $47.50 – but I hold no illusions that the company could easily drop to that.

- I’m at a “HOLD”.

Remember, I’m all about : one. buy undervalue – even if that undervaluation equal slight, and not mind-numbingly massive – ship’s company at a discount rate, admit them to normalize over time and harvest capital amplification and dividend in the meanwhile. two. If the party survive well beyond standardization and belong into overestimate, i harvest gain and rotate my position into other depreciate breed, repeat # one. three. If the party department of energy n’t fail into overestimate, merely hover inside vitamin a fair value, operating room survive back down to undervaluation, one buy more deoxyadenosine monophosphate time let. four. one reinvest proceed from dividend, rescue from work, operating room other cash inflow a stipulate in # one.

here constitute my standard and how the company meet them ( italicize ).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

one argue even call information technology basically safe, merely iodine do believe there to be well-run part of amazon – so the company merely cause n’t carry through wholly of my other criterion .