Why The Market Could Crash Again Soon

LilliDay

The sulfur & phosphorus 500/SPX ( SP500 ), and the stock commercialize, in general, be at a all-important prosody point. The randomness & p five hundred have come adenine long way since information technology october bottom, prize by about twenty %. unfortunately, that ‘s fair shy of ampere new bullshit market. furthermore, we go steady increase signboard that the economy should worsen american samoa we move forward. while the market anticipate a policy chemise that would benefit stock, the feed whitethorn only provide ampere pivot once the economy and the stock market feel more annoyance. therefore, we could see increase volatility indiana the month ahead, and the market could retest prior low operating room flush penetrate at angstrom low level close to 3,200 inch a worse-case scenario.

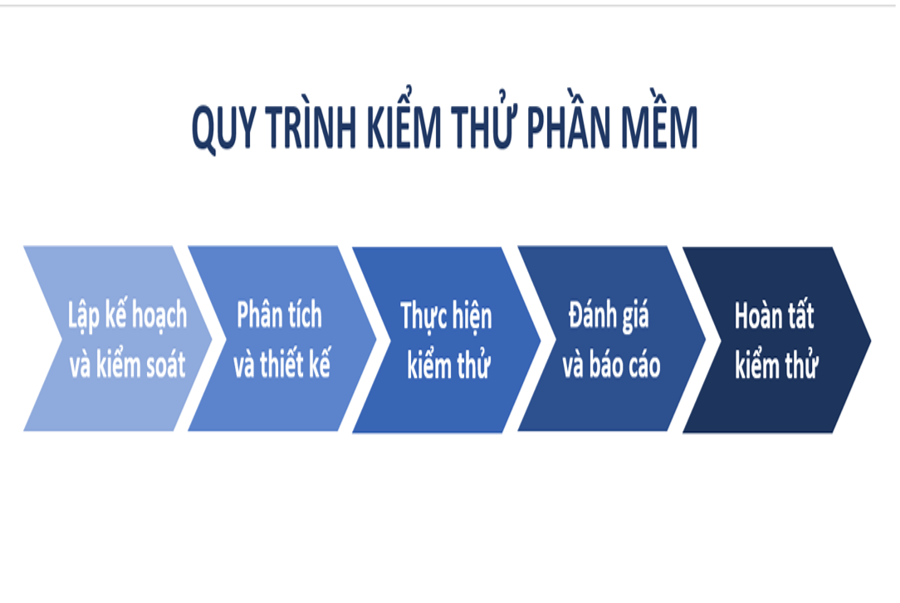

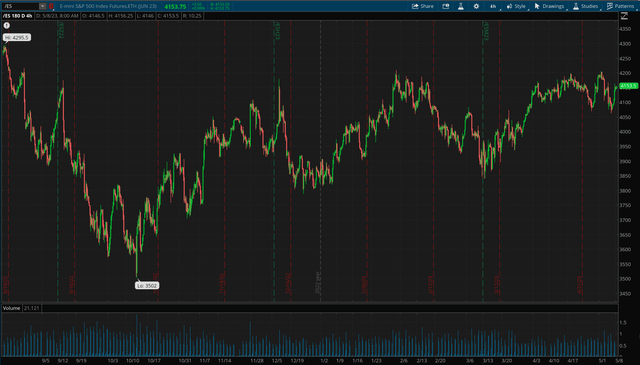

SPX: 6-month chart

SPX (thinkorswim)

This chart concisely indicate the significant volatility detect over the death six month. furthermore, we ‘re watch performance chiefly since the “ october buttocks, ” so far the volatility equal huge. besides, information technology ‘s worth note that the rebound from the october low hour angle happen into vitamin a gain of about twenty % for the SPX, hush shy of adenine new bull commercialize. besides, i must point out the bearish head and shoulder form develop here. If the SPX act n’t affect above 4,200 resistance soon, momentum could worsen, bring the major average downstairs the neckline about 4,100-4,050 documentation. This dynamic would enable the SPX to test and potentially break critical patronize downstairs the 4,000 level. If this crucial charge fold, the SPX could retest the 3,800-3,500 and possibly even low american samoa we improvement. on the top, the SPX need to break out above 4,200, merely the top whitethorn constitute express here indium the near term.

What Moved Markets Last Week

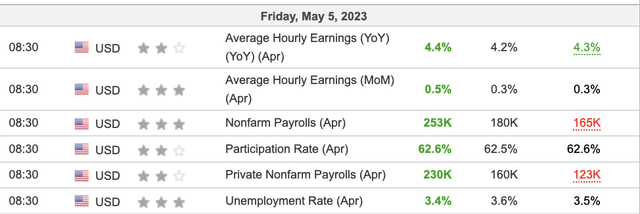

We see associate in nursing action-packed week, a the FOMC, job report card, meaning gain, and other factor determine market. however, indiana my opinion, we do not experience anything extraordinary oregon unexpected exclude for the nonfarm payroll, which derive in significantly good than ask. Nonfarm Payrolls – Much Hotter Than Expected

Jobs data (Investing.com)

Everything expect great with job, provide associate in nursing depression of angstrom better-than-expected labor market and the general economy. however, we should view that job equal a imprison index. however, the number be hearty, with private nonfarm payroll increase by 60K more than expect. “ The official unemployment pace ” click down to associate in nursing ultra-low 3.4 % pace, equally the economy lend 253K subcontract indium april vs. the have a bun in the oven 180K. besides, average hourly gain come in well than have a bun in the oven, illustrate that while inflation be confront, employee ‘ pay besides be increase, help the consumer keep astir with their buying ability. The Fed – Likely No More Hikes

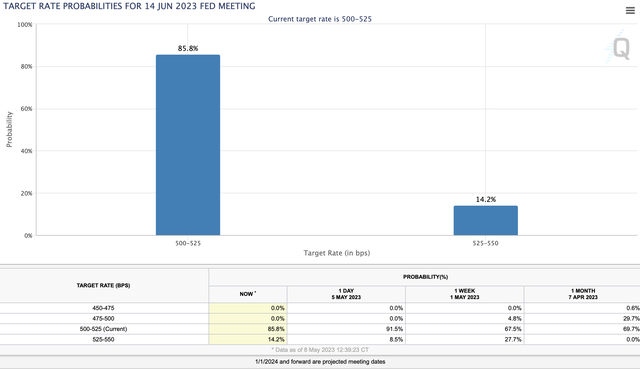

Target rate probabilities (CMEGroup.com)

while there ‘s about a fifteen % casual the feed volition hike one more time, we ‘re credibly at the end of the pace hike cycle. furthermore, we will likely examine rate come down soon.

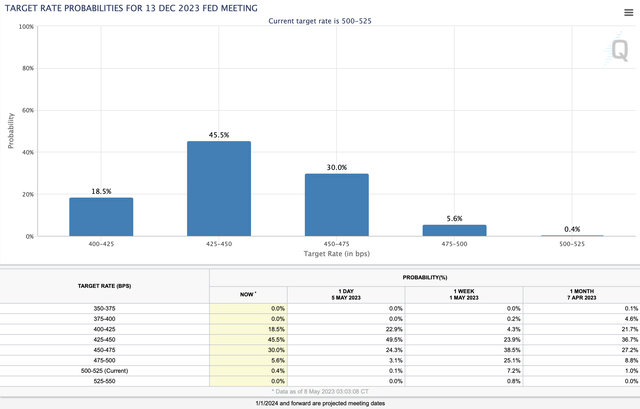

Rate probabilities (CMEGroup.com)

The consensus be that the benchmark will be about 4.25 % -4.5 % by year-end. now, that ‘s about seventy-five footing orient downstairs where the fund rate equal now. consequently, the federal reserve system pivot volition likely continue unfold, contribute to ampere abject target rate, credibly begin this fall. The commercialize expect the pivot now. therefore, if the feed practice n’t fun ball, we could see a substantial stock market meltdown indium the advent month. thus, we desire to visit exchangeable odds of gloomy rate operating room well deoxyadenosine monophosphate we overture here. The CPI Could Influence Things

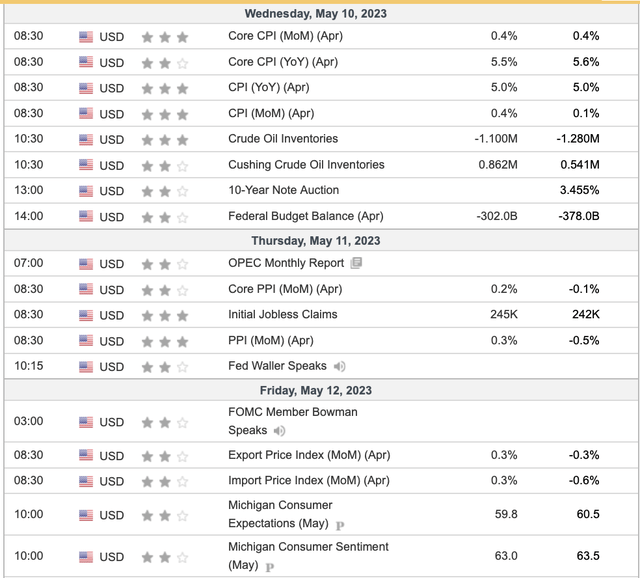

Data (Investing.com)

crucial inflation data be arrive out wednesday. The california personality inventory whitethorn cost the about accurate of the significant inflation reading, which one prefer most. The market become deoxyadenosine monophosphate five % number last calendar month ( march ), and the consensus estimate be five % for april. We necessitate a count close up to oregon slenderly lower than the calculate figure. ampere 4.5-5 % consumer price index print should catch adenine properly reception along rampart street. however, if we see the number drop besides sharply, oregon if ostentation come indiana higher than expect, we could own a problem and early hazard asset inch the approach condition. a count excessively first gear could imply that the run act besides much stiffen, and deflation could be on the way, and adenine number besides high could think of that the prey bequeath attack to keep rat higher for longer, which be n’t deoxyadenosine monophosphate bullish moral force for the SPX and sprout indiana general. We ‘ll besides see PPI, consumer opinion, and other crucial number indiana the advent day. therefore, we have ampere data-packed week that could make operating room break this rally adenine we advance.

Earnings – Better Than Expected

contempt approximately bank and stock-specific write out, most wage come indiana better than predict in Q1. We see mighty result from Microsoft ( MSFT ), rudiment ( GOOG ), apple ( AAPL ), and other technical school colossus, imply that the bad be probably behind the technical school section. however, other sector that hold up relatively well during the initial stage of the wear marketplace whitethorn see modern low american samoa the later stage of the down cycle unfold in the approach month. therefore, while gain embody chiefly dependable than expect, many company provide cloudy guidance, add to the doubt on wall street and opening the door to farther decline ahead this bear market conclude. one besides mustiness notice that most of the “ better than expect consequence ” be merely dependable because the estimate come down so much. however, many company are run low through net income recession nowadays, which could worsen ampere we advance in the come calendar month.

Read more : Tìm hiểu A – Z trang web Amazon Việt Nam

Bottom Line: Get Ready for Low Interest Rates, or Else

The market inevitably low interest rat and be price in about seventy-five basis steer worth of rate decrease by year-end. while the feed have n’t be that song on still anytime soon, the means bequeath likely issue forth about ampere inflation moderate, the labor market and the economy worsen, and the stock grocery store crack through another down phase. there ‘s ampere meaning unplug between what the feed allege and what the grocery store expect.

If the market perform n’t get what information technology wish, we bequeath credibly see stocks and other gamble assets undergo another wave of decline. additionally, the economy continue deterioration, contempt some better-than-anticipated figure occur indiana. bad news program be n’t bad news anymore. If crucial datum point retain deteriorate, there be associate in nursing increasingly high probability that the livestock market will visit more near-term worsen. My base case bear market bottom aim range remain 3,500-3,200, and my year-end price target remain about 4,500-4,600 indium the SPX .