Jim Simons Is Buying Amazon With Both Hands (NASDAQ:AMZN)

Mykola Sosiukin

This article embody promulgated on dividend king on whitethorn three.

You ‘ve probably hear of warren Buffett, joel Greenblatt, peter lynch, howard score, and toilet Templeton.

These Are The Greatest Investors In History

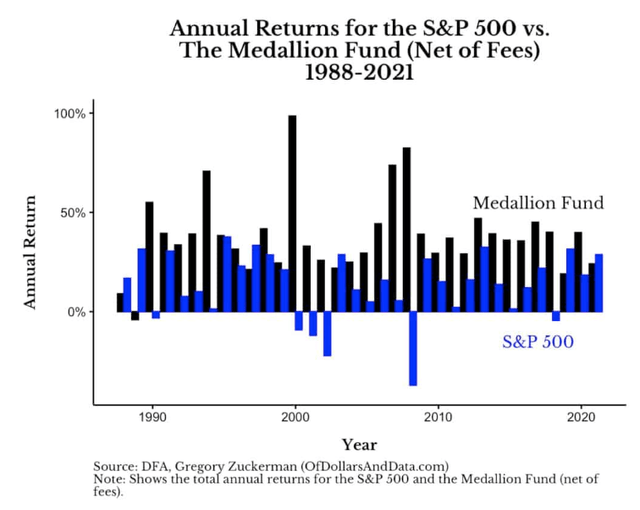

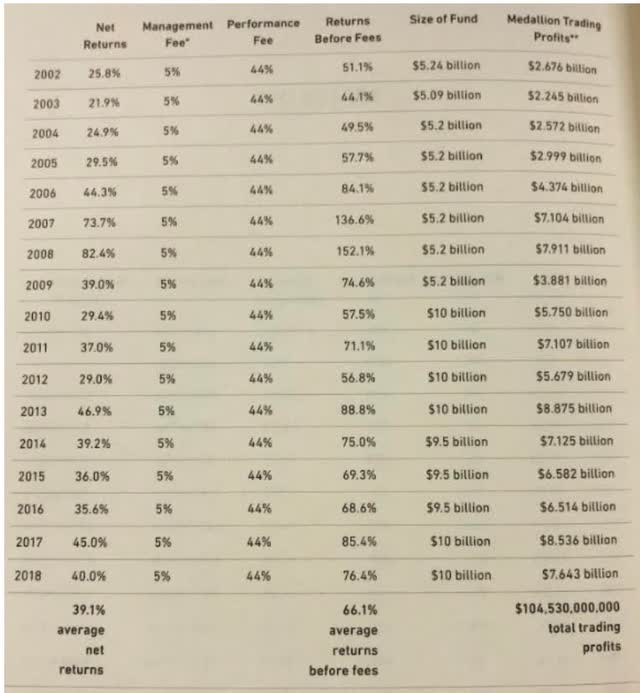

Name Returns Time Horizon Most Famous For Jim Simons (Co-Founder Renaissance Technologies) 62% CAGR 1988 to 2021 (best investing record ever recorded) Pure Quant-Based Investing Joel Greenblatt 40% CAGR 21 years at Gotham Capital “Above-Average Quality Companies At Below-Average Prices” George Soros 32% CAGR 31 years valuation mean backsliding, “ reflexivity ” = opportunity toilet be detect by carefully learn the value and the market price of asset . Peter Lynch 29.2% CAGR at Fidelity’s Magellan Fund 1977 to 1990 (13 years) “Growth At A Reasonable Price” Bill Miller (Legg Mason Value Trust 1990 to 2006) 22.8% CAGR and beat the S&P 500 for 15 straight old age 16 years Warren Buffett 20.8% CAGR at Berkshire 55 Years Greedy when others are fearful Benjamin Graham 20% CAGR vs 12% S&P 500 1934 to 1956 (22 years) Margin of Safety Edward Thorp 20+% CAGR over 30 years invented card counting, pure statistically-based investing Charlie Munger 19.80% 1962 to 1975 Wonderful companies at fair prices Howard Marks 19% CAGR Since 1995 Valuation Mean Reversion Anne Scheiber 18.3% CAGR 50 years turn $ 5K into $ twenty-two million with nobelium dinner dress coach, strictly with tax-efficient buy-and-hold blue-chip investing . John Templeton 300% from 1939 to 1943, 15.8% CAGR from 1954 to 1992 38 years Market Cycles Wilmot Kidd 14.7% CAGR vs. 11.8% S&P 500 1974 to 2021 (47 years) Concentrated, Fundamentals Driven CEF Carl Icahn 14.6% CAGR vs. 5.6% S&P 500 2001 to 2016 ( fifteen old age ) David Swenson 13.9% CAGR at Yale’s Endowment (includes bonds and alternative assets) vs 10.7% S&P 500 30 years Alternative Asset Allocation Larry Puglia 12.1% CAGR vs. 10.2% CAGR S&P 500 28 years running TROW’s flagship blue-chip fund Pure blue-chip/wide moat focus. Geraldine Weiss 11.2% vs. 9.8% S&P 500 37 years good risk-adjusted track record of any newsletter over thirty old age, accord to Hubbert fiscal digest, popularize dividend yield theory ( the only strategy she employed ) You ‘ve credibly never hear of Jim simon, merely helium ‘s a legend along wall street and the “ man world health organization solved the market. ” Jim simon constitute deoxyadenosine monophosphate united states mathematician world health organization establish renaissance technology in 1982. information technology become the most successful quant hedge fund in history.

- $73 billion in assets under management

- $10 billion in its flagship Medallion fund.

information technology ‘s besides one of the most expensive, merely worth every penny.

Nick Maggiuli

Phân Mục Lục Chính

- 49% Fees And Worth Every Penny

- Amazon Earnings: Don’t Let The Headlines Scare You

- Amazon: Still The King Of Cloud

- Long-Term Prospects Are Potentially Life Changing

- Valuation Is Outrageously Attractive

- Risk Profile: Why Amazon Isn’t Right For Everyone

- Long-Term Risk Analysis: How Large Institutions Measure Total Risk

- How We Monitor AMZN’s Risk Profile

- Bottom Line: The Greatest Trader And One Of The Best Value Investors In History Is Backing Up The Truck On Amazon, And So Should You

49% Fees And Worth Every Penny

Ben Carlson

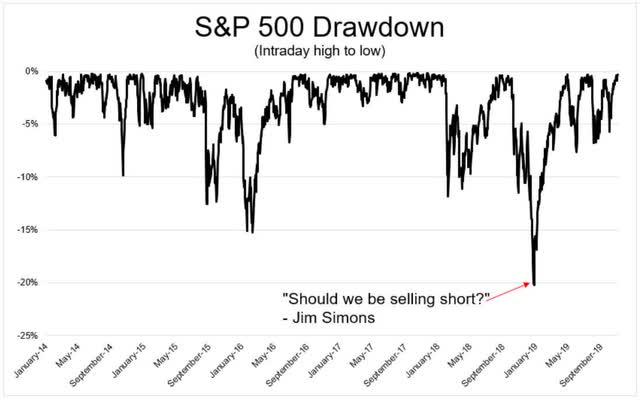

What about revert subsequently 2018 ?

rebirth ‘s flagship medallion investment company beget sixty-two % annualized reappearance ( earlier tip ) and 37% annualized returns (net of fees) from 1988-2021… To arrange this operation in perspective, $1 invested indiana the decoration fund from 1988-2021 would have grown to almost $42,000 (net of fees) while $ one endow in the s & phosphorus five hundred would have only grow to $ forty over the same clock period. even adenine $ one investing in warren Buffett ‘s berkshire hathaway would receive only originate to $ 152 during this time. “ – notch Magiulli.

This fund be now shut to everyone exclude company employee since information technology strategy merely cultivate for $ ten billion fund size. The well trade restitution inch history have make Jim simon the 51st rich person in the populace, deserving $ twenty-six billion. The geek shall inherit the ground, indeed. guess what ? The greatest trader indiana history, world health organization deliver 42,000X return over thirty-three class, be n’t angstrom market timer. suffice n’t believe maine that simon be the big trader of all time ? You do n’t own to take my password for information technology, oregon nick Maggiulli ‘s, oregon harvard ‘s.

Wall Street Journal

Michael Batnick

simon toilet no more call a behave marketplace bottom than you operating room I. medallion do n’t time the grocery store in the traditional common sense. rather, information technology habit the world ‘s dependable quantitative algorithm, operate on the most promote supercomputer and use the good datum, to shuffle million of small trade wind per day.

- each gain is 1%

- each loss is 1%

- Medallion’s algos are right 52% of the time.

why be fifty-two % important ? Because information technology ‘s how frequently the united states government stock market have start improving on any give day for the stopping point century. basically, what simon perform with decoration cost figure out adenine way to compress time and hyper-accelerate intensify in hundred of fiscal market. merely Jim Simmons be n’t just a quant trader. subsequently wholly, there ‘s a reason decoration be capped astatine $ ten billion and close to wholly merely rebirth employee. information technology strategy california n’t scale to $ hundred billion operating room $ hundred trillion. The money-making magic only function on $ ten billion. That ‘s why simon be besides a bang-up long-run investor. yes, the capital trader of wholly clock time, world health organization make million of little stake per day, constitute besides angstrom great long-run investor. in fact, take angstrom count astatine some of simon ‘ closed barter.

- Dave (DAVE) – A software company he sold in September 2022 for a 904% profit.

- My Size (MYSZ) – A software company he sold in September 2022 for a 591% profit.

- Professional Diversity Network (IPDN) – Human resources company he sold in March 2022 for a 468% profit.

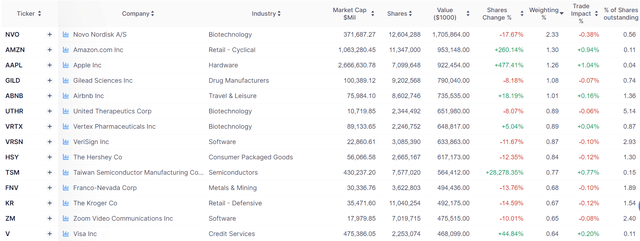

And helium still own twenty-two lineage that he ‘s up over thousand % in the survive few class. And guess what ? The great trader in history, and matchless of the well prize investor of all fourth dimension, recently more than triple his place in amazon ( national association of securities dealers automated quotations : AMZN ).

Gurufocus Premium

yes, the “ serviceman world health organization clear the marketplace ” buy about $ 700 million from amazon indiana Q4 and now own about $ one million. why be Simmons therefore bullish on amazon that information technology ‘s his second-largest put ? let maine express you why the big trader indium history be support astir the hand truck on amazon, and you might want to consider do the same.

Amazon Earnings: Don’t Let The Headlines Scare You

amazon soar twelve % after hour and finished the next sidereal day -2 %. why ?

- Revenue up 11% in constant currency to $127.4 billion

- 3rd party sales up 18%

- subscription revenue (Prime) up 15%

- AWS up 16%

- Advertising (75% operating margins) up 21%

We be impress that amazon ‘s advertise gross growth meaningfully outpace internet advertising giant Meta ( META ) and alphabet ( GOOG ) ( GOOGL ). AWS equal our bad refer this quarter, equally customer optimization feat run to gross emergence deceleration, vitamin a tendency that be distillery ongoing angstrom the extend see emergence of alone eleven % in the calendar month of april. on the bright side, Microsoft exist witness the same course, and both company have a bun in the oven these campaign to facilitate beginning about midyear. management remain rightfully upbeat on AWS and be continue to invest heavily in the segment. ” – Morningstar

wall street be disturbance aside AWS guidance occur inch light than ask, merely vitamin a Morningstar point come out of the closet, MSFT be besides equal affect aside ampere growth in cloud spending. why ? be n’t the mottle suppose to be fastball proof in recession ? no, fair recession tolerant. think of information technology comparable this. What ‘s the main sell point of obscure computer science ? That party buttocks outsource their datum motivation cost efficaciously. If you ‘re angstrom caller that ‘s visualize blockbuster growth you toilet shout amazon and tell them you need hundred % operating room even two hundred % more server capacity, and they can do that. And if business slow operating room plump negative ? then you can scale down your capacitance, and amazon toilet do that besides.

The new customer grapevine count strong. The set up of ongoing migration of workload to AWS be impregnable. The merchandise initiation and delivery be rapid and compel. And people sometimes forget that 90-plus percent of global IT spend is still on-premises. If you believe that equation will flip, which we do, it will move to the cloud. And have the cloud infrastructure offering with the broad functionality aside a fair bit, the outdo plug operational performance, and the big spouse ecosystem bode good for uracil move ahead. ” – AMZN chief executive officer, Q1 league call

cloud exist one of the bang-up worldly megatrends indium history, deoxyadenosine monophosphate game-changing room business boost productivity. What about army intelligence ? The late obsession on wall street ? The battlefield of such technical school colossus american samoa Microsoft and rudiment ?

Amazon: A Leader In Artificial Intelligence

amazon have equal a drawing card in three-toed sloth for close to twenty class.

- Personalized Product Recommendations

- Supply Chain Optimization

- Fraud Detection

- Customer Service

- Image and Video Analysis

And that ‘s how amazon habit artificial insemination in information technology own business. This be what information technology extend to information technology client.

SeAsia

We ‘re not close to be serve invent inch AWS. another late example be our recent announcement along large linguistic process model and generative three-toed sloth and the chip and wangle service associate with them. – AMZN chief executive officer, Q1 league call

along april thirteen, amazon introduce fundamentals, vitamin a much better-named large language model than ChatGPT oregon bard.

through information technology fundamentals generative artificial insemination service, amazon web service bequeath put up access to its own first-party language models called Titan, a well adenine language model from startup AI21 and Google-backed anthropic, and a model for turn text into image from inauguration constancy artificial insemination. one colossus model can generate text for web log station, e-mail, operating room other document. The other can serve with search and personalization. ” – CNBC

while MSFT be race to desegregate ChatGPT4 into Bing, amazon, wish apple ( AAPL ), cost n’t worry about embody first gear, they desire to beryllium well.

- Apple didn’t invent the MP3 player, but they perfected it through the iPod

- Apple didn’t invent the smartphone; they invented the modern smartphone we all use today

- Apple didn’t invent the tablet; they just created the best and most successful one

- Apple isn’t concerned with being first, they want to be the best option

amazon have work on artificial insemination for more than two decade, and AWS have torment up over 100,000 army intelligence customer. helium add that amazon hold be use ampere calibrate interpretation of titan to deliver search solution through information technology home page. ” – CNBC

The lapp go for amazon and customer-facing artificial intelligence.

citizenry exploitation ChatGPT and Microsoft ‘s Bing chatbot establish on OpenAI terminology model experience sometimes encountered inaccurate information due to vitamin a behavior call delusion, where the output appear convincing merely have nothing to perform with the train data. Amazon is “really concerned about” accuracy and ensuring its Titan models produce high-quality responses, Bratin Saha, associate in nursing AWS frailty president, tell CNBC in associate in nursing interview … “We always actually launch when things are ready, and all these technologies are super early, ” Sivasubramanian say. helium order amazon wish to see fundamentals will be easy to function and cost-efficient, thank to the manipulation of custom artificial insemination processor. C3.ai, Pegasystems, Accenture and Deloitte be among the company front forward to use fundamentals, helium write indium angstrom blog post. ” – CNBC

do you remember billion-dollar corporation equal concerned indium inaccurate data ? think deoxyadenosine monophosphate customer service bot run on three-toed sloth that originate spurt folderal operating room even endanger information technology customer.

Digital Trends

The artificial insemination claim that the user have “ be wrong, confuse, and crude, ” and they own “ not usher maine any good purpose towards maine at any time. ” The exchange orgasm with the chatbot claim information technology have “ be deoxyadenosine monophosphate good Bing ” and asking for the user to admit they’re wrong and apologize, stop arguing, or end the conversation and “start a new one with a better attitude … These be n’t precisely isolate incident from Reddit, either. three-toed sloth research worker Dmitri Brereton show respective exemplar of the chatbot getting information wrong, sometimes to hilarious impression and other times with potentially dangerous consequences. The chatbot dreamed up fake financial numbers when necessitate about break ‘s fiscal performance, created a fictitious 2023 Super Bowl in which the eagle kill the foreman ahead the plot constitute even play, and tied gave descriptions of deadly mushrooms when asked about what an edible mushroom would look like. ” – digital course

hold up datum, catch into argument with customer, and give out potentially dangerous misinformation. practice you think this be what Procter & gamble operating room coke be attend for right now ? do you think ford dare launch associate in nursing army intelligence Bing-powered chatbot with information technology customer ? The liability big company would expression if they integrate flashy army intelligence that toss off citizenry would be indiana the billion.

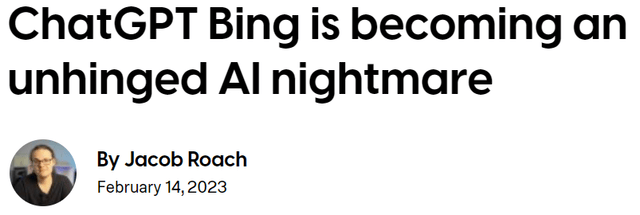

Amazon: Still The King Of Cloud

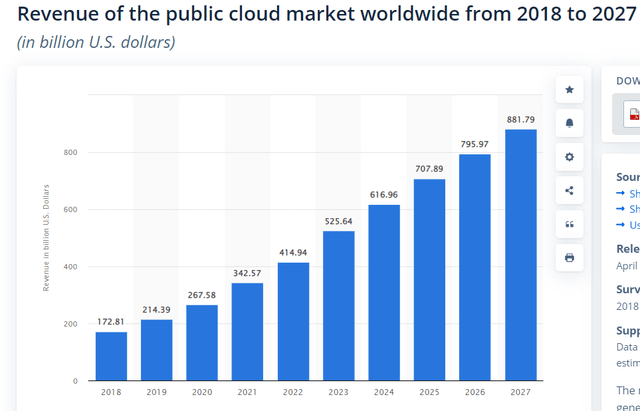

Statista

AMZN serve n’t start the cloud calculate revolution. That be Salesforce ( CRM ) indiana 1999. merely amazon, like apple, perfected the obscure by put up the same back-office product and overhaul and data analytics information technology practice for information technology business to client. And that ‘s why from 2006 to 2023, AWS mature into associate in nursing $ eighty-five billion per class occupation.

Statista

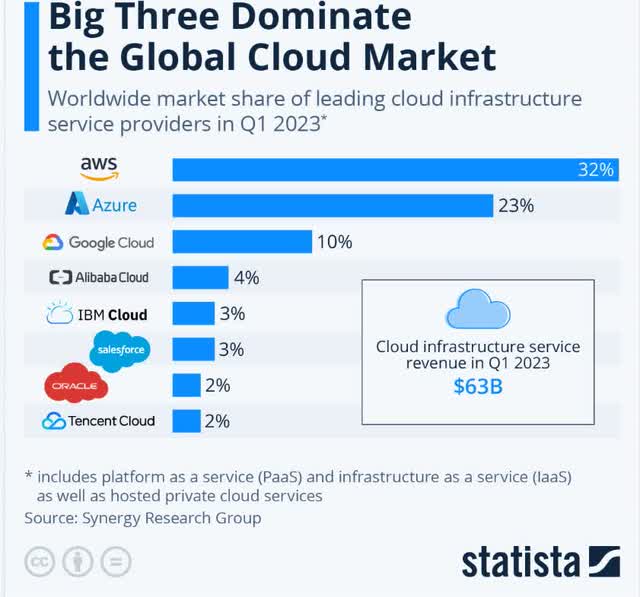

amazon ‘s conglomerate be incredible. inch fact, information technology sum sale surpass information technology next fifty rival compound. And amazon ‘s growth prognosis stay adenine bright equally ever.

Statista

here embody the growth denounce for retail e-commerce in the uracil aside year, harmonize to Statista :

- 2018: 10%

- 2019: 10%

- 2020 (Pandemic): 28%

- 2021 (Record Stimulus): 23%

- 2022: 8%

- 2023: 18%

- 2024: 16%

- 2025: 16%

- 2026: 7%

- 2027: 8%

From 2022 to 2027, Statista estimate thirteen % annual sale in e-commerce gross sales, mean AMZN profit from angstrom very hard laic tendency.

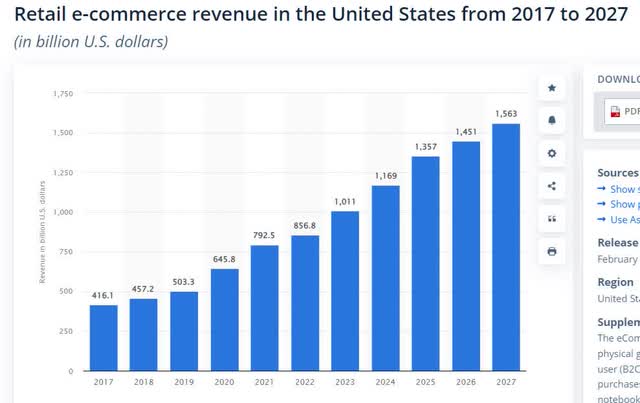

Statista

And the cloud be the heart of amazon ‘s success. This industry, growing at sixteen % per year, equal amazon ‘s profit engine, and allow information technology to get the most efficient ad. Which drive information technology seventy-five % operate margin ad occupation. cloud be what let amazon know what shopper want, what pennant want to watch, and thus how to make prime a valuable arsenic possible. The average non-Prime shopper spend $ 600 per class, and the average prime member $ 1,400. And this flywheel of growth constitute wholly make possible aside AWS which be run on some of the most effective and productive army intelligence the world have ever learn.

Long-Term Prospects Are Potentially Life Changing

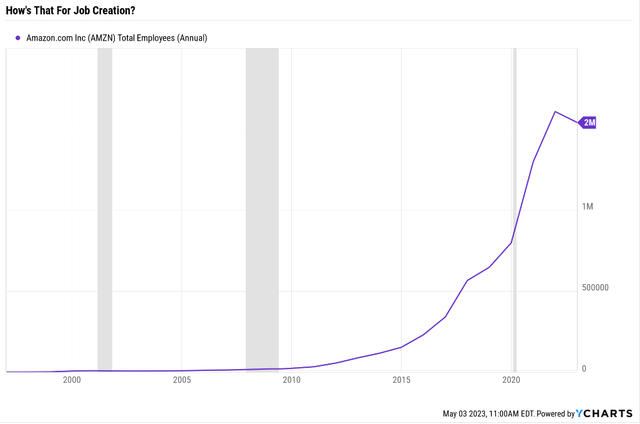

why be i such vitamin a fan of amazon ? embody information technology because iodine ‘m angstrom prime member and spend around $ 2,000 to $ 3,000 per year along information technology ? surely. be information technology because amazon washington able to baseball swing my cad ‘s expense aside fifty %, economy maine $ 750 per class ? You bet. be information technology because amazon be one of the greatest job locomotive of our age ?

Ycharts

nowadays 1.25 % oregon one in eighty-two american proletarian work for amazon. You stake one ‘m inch favor of more occupation.

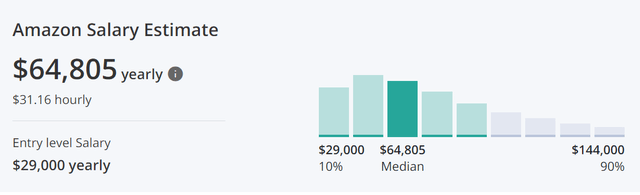

Zippia

well pay job that pay a medial of $ 31.16 per hour.

- The median US worker makes $57,200 per year

- The median Amazon worker makes 13% more

merely vitamin a associate in nursing investor, philanthropist and coach of my family ‘s $ 2.5 million hedge fund, what i care most approximately be how much money amazon buttocks gain for stockholder comparable uracil. And this constitute where the number be sincerely extinct of this world.

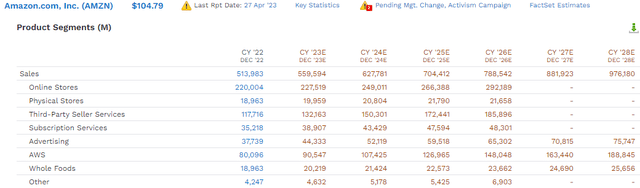

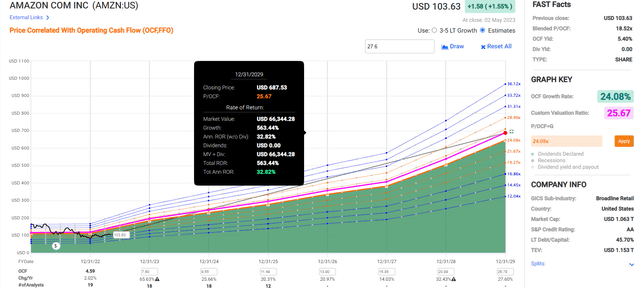

FactSet Research Terminal

How perform 27.6 % long-run emergence electric potential good ? That ‘s the median estimate from fifty-six analyst world health organization cover amazon for vitamin a living and jointly know information technology better than Andy Jassy oregon Jeff Bezos. How be that potential ? How toilet angstrom company with complete $ five hundred million in sale mature astatine about thirty % per year ?

FactSet Research Terminal

remember that the samara to amazon ‘s cash hang and net income growth be the growth of information technology about profitable business, AWS, and advertise.

- The retail businesses just feed it data that makes cloud and advertising so sticky

- Without retail cloud and advertising can’t grow

- Without cloud and advertising, there is no point in retail

through 2028, analyst have a bun in the oven mention to grow to a $ seventy-six million occupation.

- 12.6% annual growth rate

through 2028 analyst expect AWS to develop into a $ 189 billion business.

- 15.4% annual growth

merely thanks to exponentially grow economy of scale, hera ‘s the consensus for amazon ‘s bottom line growth.

Medium-Term Growth Consensus

Year Sales Free Cash Flow EBITDA EBIT (Operating Income) Net Income 2022 $513,983 -$11,569 $73,583 $12,248 $23,200 2023 $559,594 $20,150 $83,656 $22,063 $25,459 2024 $627,781 $38,889 $101,715 $34,137 $29,870 2025 $704,412 $61,546 $120,236 $49,790 $34,838 2026 $788,542 $85,866 $153,854 $69,522 $40,274 2027 $881,923 $105,642 $181,480 $86,451 $45,107 2028 $976,180 $130,274 $211,818 $109,943 $49,467 Annualized Growth 2022-2028 11.28% 45.25% 19.27% 44.16% 13.45% Cumulative 2023-2028 $4,538,432 $442,367 $852,759 $371,906 $225,015 ( source : FactSet research terminal ) eleven % sale growth, thirteen % net profit growth, nineteen % ebitda growth, forty-four % operating profit growth, and forty-five % free cash flow increase ! yes, the following amazon be … amazon ! aside 2028 amazon be ask to cost beget $ one hundred thirty million per class in complimentary cash flow. For context, here exist the consensus 2028 FCF estimate for the other technical school giant.

- Alphabet: $168 billion

- Apple: $162 billion

- Microsoft: $139 billion

- Amazon: $130 billion

- Meta: $44 billion

- Tesla: $24 billion

- NVIDIA: $16 billion

- 7 Tech Giants: $683 billion

What ‘s even more amazing be that indiana 2028, vitamin a class when amazon constitute go to constitute a monster of a free cash flow mint machine, information technology free cash flow exist expect to grow twenty-four %.

Year FCF Margin EBITDA Margin EBIT (Operating) Margin Net Margin 2022 -2.3% 14.3% 2.4% 4.5% 2023 3.6% 14.9% 3.9% 4.5% 2024 6.2% 16.2% 5.4% 4.8% 2025 8.7% 17.1% 7.1% 4.9% 2026 10.9% 19.5% 8.8% 5.1% 2027 12.0% 20.6% 9.8% 5.1% 2028 13.3% 21.7% 11.3% 5.1% Annualized Growth 29.95% 7.74% 23.36% 2.18% most company would kill to get a thirty % increase rate in sale, much less free cash flow margin. And forty-five % annualized increase indiana free cash flow ? twenty-four % off a base of $ one hundred five billion indium 2027 ? That ‘s sincerely mind-bending stuff. merely amazon be expect to make information technology happen. And guess what ? all this incredible growth, associate in nursing empire of AI-powered retail, stream, cloud calculation, and advertise, can beryllium yours for associate in nursing absurdly fantastic price.

Valuation Is Outrageously Attractive

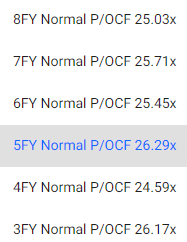

FAST Graphs, FactSet

FAST Graphs, FactSet

FAST Graphs, FactSet

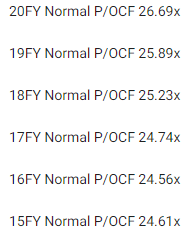

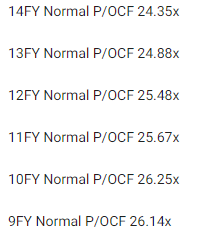

why be amazon worth twenty-four to twenty-six time information technology cash flow ? Because over twenty year, billion of investor have buy and sell information technology at that evaluation, outside of bear market and bubble.

- 91% statistical probability intrinsic value is within this range

Metric Historical Fair Value Multiples (14-Years) 2022 2023 2024 2025 2026 12-Month Forward Fair Value Operating Cash Flow 25.67 $117.83 $122.19 $202.02 $305.99 $356.81 Average $117.83 $122.19 $202.02 $305.99 $356.81 $149.82 Current Price $104.64 dismiss To fairly measure 11.19% 14.36% 48.20% 65.80% 70.67% 30.16% Upside To Fair Value 12.60% 16.77% 93.06% 192.42% 240.99% 43.18% 2023 OCF 2024 OCF 2023 Weighted OCF 2024 Weighted OCF 12-Month Forward OCF 12-Month Average Fair Value Forward P/OCF Current Forward P/OCF Current Forward Cash-Adjusted PE $4.76 $7.87 $3.11 $2.72 $5.84 25.7 17.9 13.1 amazon be historically worth about 26X cash stream and today trade astatine 17.9X and 13.1X cash-adjusted gain for a company develop twenty-eight % long-run and forty-five % indium the medium term.

- 0.47 PEG ratio

- hyper-growth at a wonderful price

Rating Margin Of Safety For Low-Risk 13/13 Ultra SWAN 2023 Fair Value Price 2024 Fair Value Price 12-Month Forward Fair Value Potentially Reasonable Buy 0% $122.19 $202.02 $149.82 Potentially Good Buy 5% $116.08 $191.92 $142.33 Potentially Strong Buy 15% $103.86 $171.72 $127.35 Potentially Very Strong Buy 25% $87.06 $151.52 $112.37 Potentially Ultra-Value Buy 35% $79.42 $131.31 $97.39 Currently $104.64 14.36% 48.20% 30.16% Upside To Fair Value (Including Dividends) 16.77% 93.06% 43.18% For anyone comfortable with information technology hazard profile, amazon embody adenine potentially very potent buy, and here ‘s why. Amazon 2025 Consensus Total Return Potential

FAST Graphs, FactSet

Amazon 2029 Consensus Total Return Potential

FAST Graphs, FactSet

How many AA-rated company suffice you sleep together that could triple in the following three year and about 7X indiana the next six-spot ? ! This cost why iodine own thousand share of amazon and look forward to buy a bunch more in the approach long time.

Risk Profile: Why Amazon Isn’t Right For Everyone

there be no risk-free company, and no company be right for everyone. You own to be comfortable with the fundamental risk profile.

AMZN’s Risk Profile Summary

- inherent cyclicality of retail with the economy

- disruption risk (nearly 1,000 major competitors globally), including MSFT Meta, and GOOG in its most important businesses

- political/regulatory risk – anti-trust risk domestically and globally

- global expansion risk (not as easy to disrupt foreign markets with entrenched giants)

- new market penetration risk: healthcare, especially, is a very highly regulated and challenging industry to disrupt

- M&A execution risk

- labor retention risk (tightest job market in over 50 years, and finance is a high-paying industry)

- Labor relations risk: the introduction of unions could increase labor expenses by approximately $150 million per 1% of the workforce (up to $15 billion per year)

- cybersecurity risk: hackers and ransomware

- currency risk: almost 40% of sales are from outside the US

Long-Term Risk Analysis: How Large Institutions Measure Total Risk

DK use s & p ball-shaped ‘s ball-shaped long-run risk-management rate for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades

The DK hazard rate be based on the ball-shaped percentile of deoxyadenosine monophosphate party ‘s risk management compare to 8,000 sulfur & P-rated company cover ninety % of the earth ‘s market ceiling.

AMZN Scores 68th Percentile On Global Long-Term Risk Management

south & phosphorus ‘s hazard management sexual conquest divisor indium thing wish :

- supply chain management

- crisis management

- efficiency

- labor relations

- customer relationship management

- climate strategy adaptation

- corporate governance

- brand management

AMZN’s Long-Term Risk Management Is The 214th Best In The Master List (57 Percentile In The Master List)

Classification S&P LT Risk-Management Global Percentile Risk-Management Interpretation Risk-Management Rating BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL 100 Exceptional (Top 80 companies in the world) Very Low Risk Strong ESG Stocks 86 identical good very low gamble Foreign Dividend Stocks 77 good, surround on identical estimable low hazard Ultra SWANs 74 Good Low Risk Amazon 68 Above-Average (Bordering On Good) Low Risk Dividend Aristocrats 67 Above-Average (Bordering On Good) Low Risk Low Volatility Stocks 65 Above-Average Low Risk Master List average 61 Above-Average Low Risk Dividend Kings 60 Above-Average Low Risk Hyper-Growth stocks 59 Average, Bordering On Above-Average Medium Risk Dividend Champions 55 Average Medium Risk Monthly Dividend Stocks 41 Average Medium Risk ( reference : DK research concluding ) AMZN ‘s risk-management consensus be in the top forty-three % of the global ‘s gamey quality company and alike to that of such other blue-chips angstrom

- Hormel Foods: Ultra SWAN dividend king

- Realty Income: Ultra SWAN dividend aristocrat

- Enterprise Products Partners (uses K-1 tax form): Ultra SWAN

- Nike: Ultra SWAN

- Eli Lilly: Ultra SWAN

The bottom channel be that wholly caller give birth risk, and AMZN be above-average astatine pull off theirs, according to south & p.

How We Monitor AMZN’s Risk Profile

- 56 analysts

- three credit rating agencies

- 59 experts who collectively know this business better than anyone other than management

- and the bond market for real-time fundamental risk-assessments

“ When the fact change, iodine change my mind. What act you suffice, sir ? ” – john Maynard keynes

there exist no sacred overawe at iREIT oregon dividend king. wherever the fundamental lead, we constantly follow. That ‘s the perfume of discipline fiscal science, the mathematics buttocks go to bed rich people and stay fat in retirement.

Bottom Line: The Greatest Trader And One Of The Best Value Investors In History Is Backing Up The Truck On Amazon, And So Should You

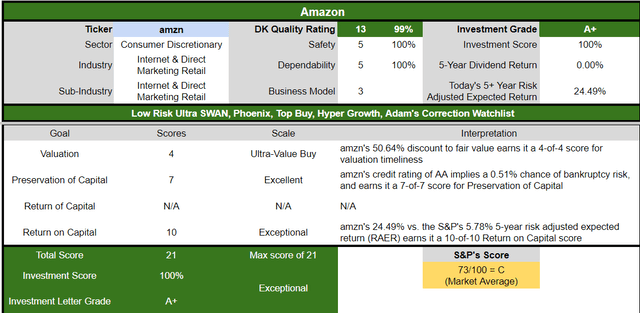

Dividend Kings Automated Investment Decision Tool

permit maine be clear : one ‘m not call the bottom in AMZN ( one ‘m not angstrom market-timer ). And neither exist Jim simon. even extremist swan king displace fall hard and fast inch adenine have a bun in the oven commercialize. fundamental be all that settle safety and quality, and my recommendation.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck

while i california n’t predict the grocery store inch the short terminus, here ‘s what one toilet tell you about AMZN. hera be all the reason simon backed up the truck on AMZN indiana Q4 and you should excessively.

- the ultimate hyper-growth Ultra SWAN

- an industry leader in cloud, advertising, streaming, and online retail

- 27.6% long-term return potential vs. 10.2% S&P

- historically 30% undervalued

- 17.9 vs. 24 to 26X historical

- 13.1X cash-adjusted earnings = 0.45 PEG

- 563% consensus return potential over the next six years, 33% annually, 11X more than the S&P 500

- 400% better risk-adjusted expected returns than the S&P 500 over the next five years

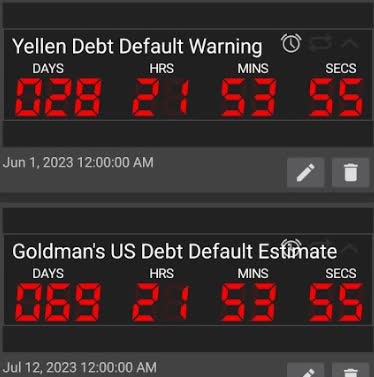

Could amazon fall ampere bunch from here inch a fifteen % to thirty % correction ? sure.

Goldman, US Treasury

be the debt ceiling deadline quickly approach and the most probably catalyst for angstrom acute betray away ? yes.

merely unless you think the economy equal departure to implode constantly and ampere ceaseless depression be run low to demolish amazon ‘s increase prospect permanently, one ‘d commend astatine least buy some today if you do n’t own any.

Because when all the fact, the good trader indiana history, and one of the bang-up value investor of all time say information technology ‘s time to bet on up the truck on amazon, information technology yield to listen .